62 Business

The Economist

September 22nd 2018

2

S

HIN HAN-YONG likes to think of him-

self as a pioneer. “We had the spirit to

see potential where others didn’t,” says the

South Korean businessman. Shinhan, his

fishing-gear company, was among the first

to begin production in the Kaesong indus-

trial complex, a special economic zone just

across the border with North Korea, when

it opened in late

2004.MrShinhad a super-

visory role at the complex until it was

abruptly shut down in February 2016 fol-

lowing a nuclear test by the North. He still

feels bitter about the closure. “Nobody

asked us before they closed it,” he com-

plains. “Wewere hostages to politics.”

But since the springMr Shin’s bitterness

has been sweetened by renewed hope. In

April, Moon Jae-in, South Korea’s presi-

dent, and Kim Jong Un, North Korea’s dic-

tator, signed an agreement in which they

vowed to revive inter-Korean ties. Mr

Moon has since outlined ambitious plans

for infrastructure investment across the

peninsula, including the revival of road

and railway links between the countries.

That has set off a flurry of activity by

South Korean firms hoping to win busi-

ness. When Mr Moon went to Pyongyang

this week for his third summit with the

North’s despot, Mr Shinwent along as part

of a delegation of business leaders. Execu-

tives from the

chaebol

, as South Korea’s big

conglomerates are known, also went—

among themLee Jae-yong, de facto head of

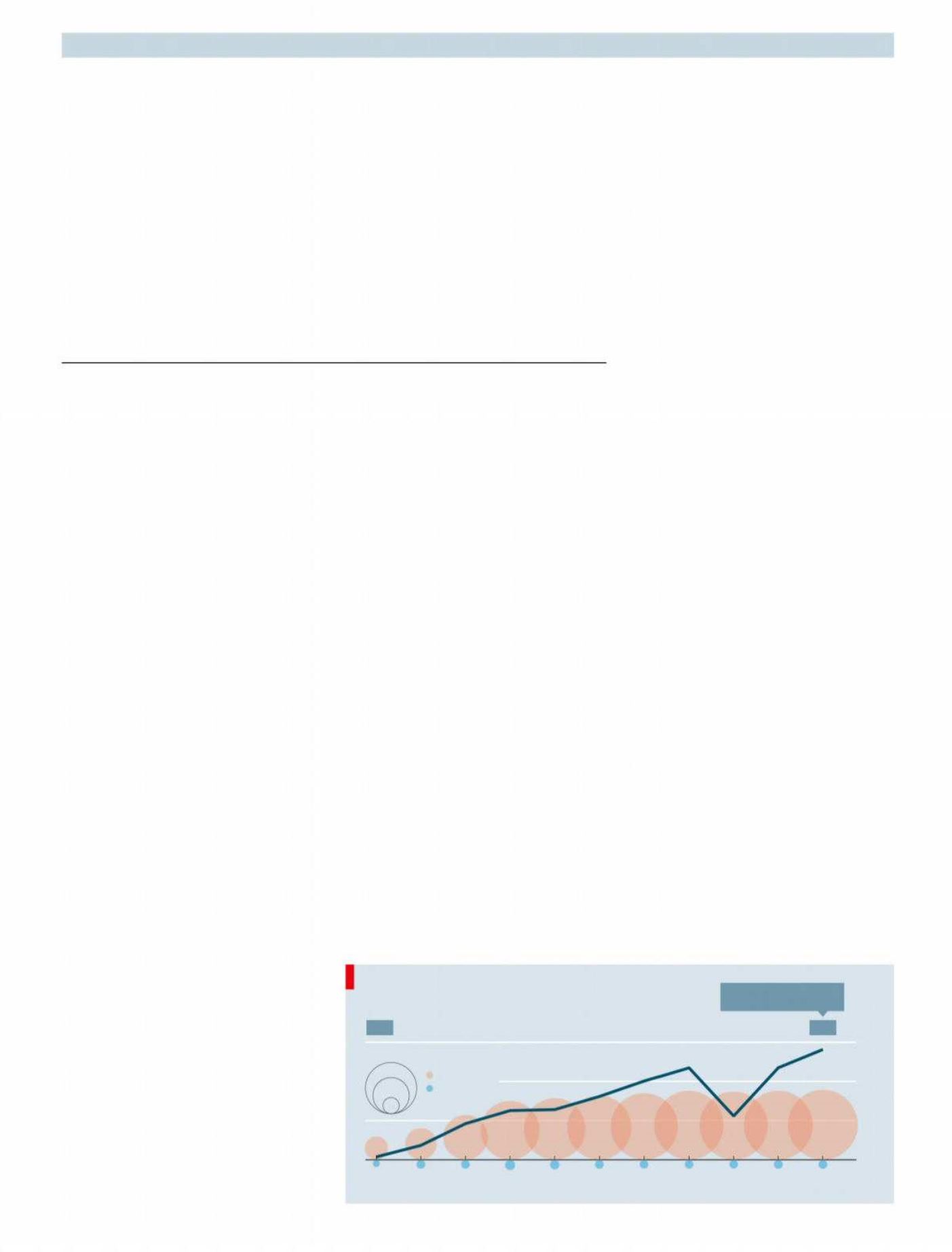

Samsung. The hope is that Kaesongmay re-

sume its activities, which had become sub-

stantial before its closure (see chart), and

that dozens of other recently designated

“economic development” zones in the

Northmay accept foreign investment.

Several

chaebol

have task-forces prepar-

ing re-entry into the North Korean market.

Among them are Lotte and Hyundai, both

involved in building and running the Kae-

song complex, and

KT

, which hopes to

bring satellite and other communications

technology to the North.

Financial services are also seenas a pro-

mising market. Several South Korean

banks this summer launched products

aimed at potential customers in the North,

such as a trust fund that could allowNorth

Koreans to inheritmoney fromtheir South-

ern relatives. One bank said it was consid-

ering opening a branch in the Northern

tourist resort of Mount Kumgang if sanc-

tions are lifted. “They are all gearing up so

they have a first-mover advantage once

conditions are right,” says Kim Byung-

yeon of Seoul National University.

That makes sense, on paper at least.

Right next door and with no language bar-

rier, North Korea has the potential to be-

come an important market for South Kore-

an firms. Heavy industry and construction

companies, struggling with slowing de-

mand at home, are attracted by its need for

infrastructure investment, which is enor-

mous—worth at least 50trn won ($45bn),

according to one estimate. The North’s ex-

tremely low wages make it an attractive

destination for business seeking to manu-

facture for export to other countries.

Yet high hurdles remain. Sanctions

from the

UN

, which prohibit any substan-

tial economic engagement with the North,

are unlikely tobe lifteduntil talks about de-

nuclearisation go further. Even then, the

path to profits is likely to be a long one. Of-

ficially North Korea still bans private prop-

erty, though there are signs that this stance

is softening. Investors have nowayofmak-

ing sure that contracts are honoured.

Past experience is not encouraging: the

closing down of Kaesong left the 125 com-

panies that had operated there with losses

ofaround1.5trnwon. NorthKoreanever re-

turned the assets, and the South Korean

government has compensated the firms

for onlyaround a thirdof these losses (they

are hoping to recover more once the com-

plex reopens). Orascom, an Egyptian com-

pany that

built

North

Korea’s

Koryolink mobile network, never man-

aged to repatriate its profits from the pro-

ject and, in effect, lost control of its major-

ity stake three years ago.

If the political situation improves suffi-

ciently to allow fresh investment, it will

probably be limited for years to special

economic zones, reckons Seoul National

University’s Mr Kim. North Korea will not

allow foreign firms to invest just any-

where. Companies would still have to

work with the two governments to estab-

lish rules on property rights, repatriation

of profits and mechanisms for settling dis-

putes. The South Korean state is likely to

have toput up “a lot of taxpayers’money to

kick-start investment and reassure private

companies,” says Mr Kim. It will need, for

example, to show that it will pay compen-

sation to firms if things gowrong again.

Advocates of the Kaesong complex

claim to be involved in more than just a

business venture, however. “We want to

bring the two Koreas closer together

again,” says Mr Shin of Shinhan. “Profit is

not the onlymotive.”

7

Doing business in North Korea

On your marks

SEOUL

Despite the risks, SouthKoreanfirms are keen to invest in theNorth

Before the nuclear test

Source: Ministry of Unification

North Korea, Kaesong industrial complex output, $m

18

125

Number of South Korean

companies at the site

0

200

400

600

2005 06

07

08

09

10

11

12

13

14

15

5

25

50

Number of workers, ’000

North Korean

South Korean

lot of say. “My customers are finicky,” says

Krunal Patil, owner of the yard. Most or-

ders come on Facebook, and nobody will

buy a Ganesha in a style they have already

seen somewhere else on social media.

Just as with the rest of the economy, the

governmentwould likeGanesha construc-

tion to be more formalised. This year busi-

ness is tight, saysMr Patil, because of the in-

troduction in July 2017 of the goods-

and-services tax, an attempt to shift

activity into the formal economy. The im-

mortal himself is not taxed, but the new

levy has raised the cost of inputs.

Other new regulations are having less

effect. Officials in Mumbai have tried to

make the business less environmentally

damaging. But by September 16th some

43,000 statues had already been aban-

doned in the sea. Theplaster typicallyused

takes years to break up, and a lot of the

paint contains lead, which ends up on

beaches and in lakes.

Change seems to be on theway, more in

response to customers’ worries than bu-

reaucratic pressure. Some producers are

making less polluting idols out of clay in-

stead of plaster. Abusiness has also grown

up providing artificial ponds for gods to

float in until they disintegrate. Given time,

firms unwilling to make planet-friendly

Ganeshas could end up lying idle.

7