66 Finance and economics

The Economist

September 22nd 2018

1

2

be redundant in two economies that have

embraced flexible exchange rates. If the

trade deficit is unsustainable, a floating

currency is supposed to weaken, thereby

discouraging imports (and encouraging ex-

ports) automatically. By this logic, the de-

clining rupee and rupiah will eventually

resolve the problem they reflect.

But Indonesia worries that its foreign-

currency debts will be harder to sustain

with aweaker rupiah. These debts amount

to about 28% of

GDP,

far below Turkey’s

andArgentina’s totals, but are still too large

to ignore. Moreover, about 40% of its rupi-

ah-denominated government bonds are

held by foreigners, according to Joseph In-

calcaterra of

HSBC

, a bank. That “presents

a sizeable outflow risk,” he says, which is

one reason why Indonesia’s central bank

has raised interest rates faster than India’s.

Both countries also worry that falls in

the currency will beget further falls. After

fighting the rupiah’s slide in 2013, Chatib

Basri, Indonesia’s finance minister at the

time, argued that a sharp drop in the cur-

rency would have revived memories of

the crisis in1997 and led to investor panic.

That wobble in 2013 followed some

stray remarks from America’s Federal Re-

serve, which suggested it might soon slow

its asset purchases. The subsequent spike

in Treasury yields caused turmoil in

emerging markets and threatened Ameri-

ca’s fragile recovery, prompting the Fed to

clarify and soften its position. Themore re-

cent increase in Treasury yields is different.

It reflects a robust American expansion, re-

inforced by generous corporate-tax cuts.

This time, there is little reason to expect a

rethink at the Fed. America does not feel

emergingmarkets’ pain.

Asia has long dreamed of “decoupling”

fromAmerica so it can prosper evenwhen

the world’s biggest market does not. In-

stead, it is suffering even when America is

not. And partly because America is not.

7

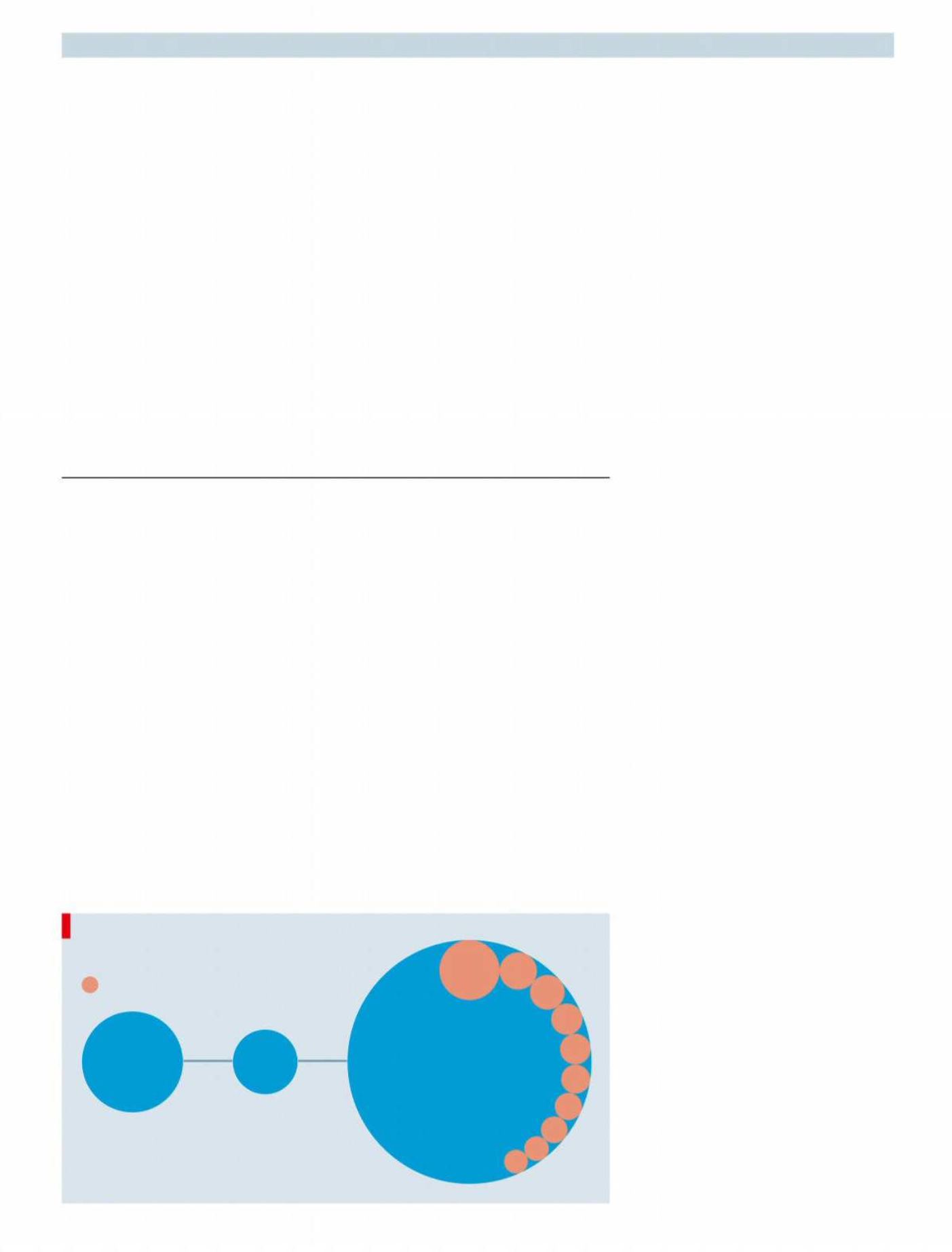

A

NOTHER week, a further ratcheting up

of trade tensions between America

and China. On September 17th President

Donald Trump announced that he had ap-

proved a furtherwave of tariffs onChinese

imports. From September 24th, imports of

products which in 2017 were worth as

much as $189bn, including furniture, com-

puters and car parts, will be hit with duties

of 10%. The Chinese have promised to re-

taliate on the same day with duties on

$60bn of American exports. Unless peace

breaks out before the newyear, the Ameri-

can ratewill increase to 25% on January1st.

Mr Trump frequently rants about how

the Chinese have long taken advantage of

Americans. But American bureaucrats

stress that the duties come after careful de-

liberation. The Office of the United States

Trade Representative (

USTR

) took seven

months to write a report detailing China’s

unfair trade practices. Each tranche of ta-

riffs has been consulted on and then re-

vised. The latest set came after the

USTR

’s

office had received 6,000 written submis-

sions and held six days of hearings.

Comparedwith an earlier proposal, the

latest tariff list excludes products worth up

to $30bn. Child-safety seats and safety

headgear were exempted. Antiques more

than a century oldwere spared, too. (Some

had pointed out that the Chinese govern-

ment restricted their export anyway.) De-

spite Mr Trump’s warning on September

8th that prices of products made by Apple

may increase as a result ofhis tariffs, smart-

watches and bluetooth devices were re-

moved from the list.

The Trump administration claims that

these deliberations have helped to min-

imise the impact on the American con-

sumer. The staggered tariffrate is supposed

to give importers time to change their sup-

pliers. Wilbur Ross, the commerce secre-

tary, was mocked online for claiming that,

because the tariffs are spread over thou-

sands ofproducts, “nobody’s going to actu-

ally notice it at the end of the day”. But in

support of his claim, economists at Gold-

man Sachs, a bank, estimate that the 10%

tariff rate will boost inflation by only

around 0.03 percentage points, and the in-

crease to 25% by a further 0.05 next year.

Still, this diligence was not welcomed

by all. More than three-quarters of the pro-

ducts that will be affected on September

24th are intermediate and capital goods,

which means the most immediate impact

will be to push up American businesses’

costs. Mr Trump’s announcement trig-

gered complaints from industry represen-

tatives including the

US

Chamber of Com-

merce, the American Chemistry Council

and the American Apparel and Footwear

Association, all of which warned that

Americans would end up footing the tariff

bill, and pleaded for a different approach.

Although it claims to be following due

process, the Trump administration’s ac-

tions are far removed from the procedures

of the rules-based global trading system.

Ordinarily, members of the World Trade

Organisation (

WTO

)would take their com-

plaints to the body’s judges. If such accusa-

tion are upheld, then those judges allow

limited retaliation.

In 2012, for example, the American gov-

ernment complained to the

WTO

that the

Chinese government was breaking the

rules by restricting the export of rare-earth

elements. China’s dominance in their glo-

bal supply meant that this hurt American

manufacturers by pushing up prices for

their inputs. After the

WTO

’s judges sided

with the Americans, the Chinese govern-

ment dropped themeasures.

The Trump administration claims that

the

WTO

’s incomplete rule book makes it

incapable of dealing with China’s alleged

misdemeanours, which include forcing

foreign companies to hand over their tech-

nology. But, even as it complains, America

is simultaneously weakening the system

bywhich the

WTO

’s rules are enforced, by

blocking the appointment of judges to the

body’s court of appeals. From October,

only threewill be left—theminimumneed-

ed to rule on a case.

On September 18th CeciliaMalmström,

Trade

Tit for tat

WASHINGTON, DC

America andChina are nowembroiled in a proper tradewar

The universe is expanding

Sources: Goldman Sachs; US Census

Bureau; ITC Market Analysis Tools

*Figure includes all switching and

routing devices ($23bn). Some of

these are excluded from tariffs

Chinese imports affected by US tariffs

Value, 2017

$32.5bn

July 6th 2018

August 23rd 2018

$189bn*

To take effect from

September 24th 2018

Circuit

boards

Desktop

computers

Metal

furniture

Computer parts

Wooden furniture

Wooden seats

Converters

Road wheels

Light

bulbs

Vacuum

cleaners

Top ten Chinese products

on latest list

$13.4bn