The Economist

May 5th 2018

Business 61

1

2

core says it “entirely rejects” the calcula-

tion. According to audited accounts,

KCC

’s

last payments to a Gertler-related com-

panywere $54.7m in 2015. OnMay1st Glen-

core won a temporary injunction in a Lon-

don court against Mr Gertler taking further

legal action against

KCC

. But the court did

not rule on the legality of the Congo pro-

ceedings, and Glencore’s assets there re-

main frozen—at least until another hearing

onMay11th.

Mr Gertler’s move puts serious strain

on Glencore’s operations in Congo, where

it is the biggest producer of both copper

and cobalt. It is under attack there on other

fronts, too. Last month Gécamines started

legal proceedings in the

DRC

to dissolve

KCC

, in which it is a joint-venture partner

with Glencore’s Toronto-listed subsidiary,

Katanga Mining, arguing that

KCC

’s $9bn

debt is draining the firm for Glencore’s

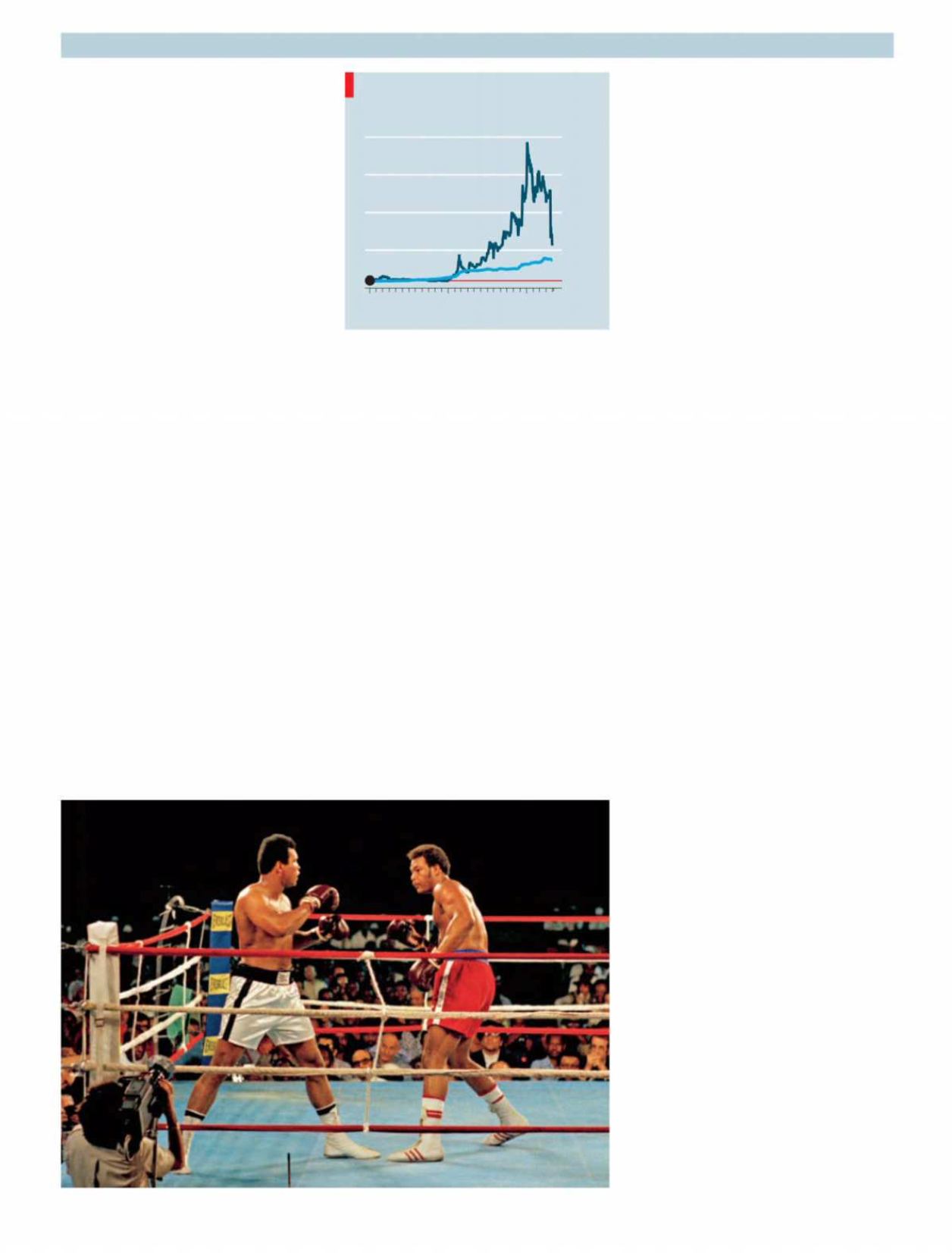

benefit. Katanga’s shares, which soared

last year on the strength of rising cobalt

prices (see chart), have plunged on fears

that Gécamines may nationalise the mine

and sell it to a Chinese rival.

Glencore says it hopes to recapitalise

KCC

to save it from the possibility of na-

tionalisation

. NGO

s pressing for greater

transparency in Congo, such as Belgium-

based Resource Matters, say that would be

long overdue. They say the debts (mostly

borrowed from Glencore-related compa-

nies) have helped

KCC

cut its tax bill in a

poverty-stricken country in dire need of

roads, schools and hospitals.

Yet even if that matter is settled, Glen-

core faces another round of pain—a new

mining code that could sharply raise royal-

ty rates on mineral production. Glencore

and other global mining firms in the

DRC

have so far failed to persuade the authori-

ties in Kinshasa to relax some of the terms

ofthe code, though negotiations are said to

be continuing.

MrGlasenbergmaybe partially reaping

what he sowed, analysts say. His firm long

did business with Mr Gertler, despite re-

ports about the latter’s relationship with

Mr Kabila. OtherWesternmining firms say

they steer clear of the

DRC

because of rep-

utational and legal risks. Glencore’s tra-

vails may be the result of Mr Kabila—who

has overstayed his second, and supposed-

ly final, term in office—squeezing mining

firms for cash to stay in power.

Glencore may survive the slugfest.

Some analysts say it may be encouraged to

make a big tax prepayment to Gécamines

to preserve its assets (it would probably

have to verify where that money goes).

Others say it may attempt to convince

America’s Treasury to relax sanctions

against Mr Gertler (companies may have

similarly intervened in the case of Rusal, a

Russian aluminium producer that has

been sanctioned by America—see

Schumpeter). But that is unlikely. Mean-

while, the gloves are off.

7

Kiboshed by Kabila

Source: Thomson Reuters

Prices, January 1st 2016=100, $ terms

2016

17

18

0

500

1,000

1,500

2,000

Katanga Mining shares

Cobalt

Will it end with a knockout?

I

TWAS not the sort ofdo-it-yourself activ-

ity that Castorama, a French home-im-

provement chain, usually promoted. The

search engine on the firm’s website started

offering customers puerile responses to

their inquiries. Its auto-complete text func-

tion suggested such intriguing products as

a “bollock hammer” or “cock sander”. It

also returned offensive anti-Semitic

phrases. The firmblamedmanipulationby

unnamedactors andhad tobriefly scrap its

search function.

That incident, two years ago, was a re-

minder that much online search occurs

within websites. Internet giants such as

Google excel at bringing users to sites but

once there customers often rely on web-

sites’ own search functions to find pro-

ducts or services. Some firms build their

own engines; others use open-source soft-

ware, such as Elasticsearch, to supply

them. The results can sometimes be pain-

fully slowand undiscerning.

As e-commerce grows, so does demand

for search systems that are fast, accurate

and resilient to typos or tampering. A firm

that sawan opportunity in this is Algolia, a

French startup founded in 2012. It has a

search application that hunts the client’s

website and swiftly offers consumers rele-

vant results.

Algolia is growing unusually fast for a

European startup. It has some 200 engi-

neers and other staff, up from 60 in 2016,

most of them based in penthouse floors at

its new headquarters behind Paris-Saint-

Lazare station (its legal headquarters and a

marketing office are still in San Francisco).

The firmsays it has over 4,500 clients,more

than double the tally of two years ago,

mostly in America. Its platform is process-

ing 41bn search requests a month, as of

March, again more than double the equiv-

alent figure two years ago.

One client, Twitch, a live-streaming vid-

eo platform owned by Amazon, sees near-

ly 1bn visits to its site each month, leading

to lots of searches. Other customers in-

clude Stripe, a cloud-based payments firm;

Medium, a publisher; Crunchbase, a data-

base for techies; and various Fortune 500

and

CAC

40 firms.

Its figures sound impressive, but there is

no ad spending attached to its searches

since users are already on company web-

sites. Algolia’smodel is to charge clients for

its bespoke service, rather than selling ads

and scooping up data about users. Its rev-

enues reached $1m in 2014, two years after

Entrepreneurship in France

Seeking the big

time

PARIS

Asite-search startup swiftly scales

РЕЛИЗ ПОДГОТОВИЛА ГРУППА "What's News"

VK.COM/WSNWS