The Economist

May 5th 2018

59

For daily coverage of business, visit

Economist.com/business-finance1

J

OHN LEGERE, the lion-maned boss of

T

-

Mobile, made his wireless firm the fast-

est-growing carrier in America by cutting

prices and giving customers better deals

than

AT

&

T

and Verizon, which he relent-

lessly mocked on Twitter as retrograde be-

hemoths. His personal brand as an indus-

try maverick may have helped too. On

April 29th he put that image to the test,

agreeing to a combination with Sprint, the

next largest carrier after

T

-Mobile, and cre-

ating a behemoth under his leadership.

The deal, all in shares, values the com-

bined entity at $146bn including debt. If

approved by regulators, it would squeeze

the number of providers in the wireless

market in America from four to three. That

is a big “if”—twice earlier this decade, anti-

trust authorities have either stepped in to

prevent such an outcome or indicated that

they would do so, for fear of higher prices

for consumers.

Mr Legere presumably knows the chal-

lenge, sohe appealed to the political priori-

ties of President Donald Trump. First came

a promise that the union with Sprint

would add thousands of jobs in America

(despite also promising shareholders $6bn

of annual savings, mostly cost cuts). Sec-

ond, he pledged that the two firms would

spend $40bn within three years to build a

national 5

G

mobile broadband network

much more quickly than either Verizon or

AT

&

T

, by taking advantage of a combina-

bile andput Sprint in charge. Instead Sprint

gave up its third-place position in the wire-

less market while consistently losingmon-

ey, raising the spectre of bankruptcy.

Calling the deal a merger seems a face-

saving gesture for Mr Son. The new com-

pany will be called

T

-Mobile, Mr Legere

will run it and Deutsche Telekom, its par-

ent firm, will own a plurality of shares. But

SoftBank won better terms than analysts

expected, getting 27% of the new company

and four board seats, including one for Mr

Son. He will be able to switch attention

from Sprint to his new $100bn Vision

Fund, a giant technology fund.

The two companies argue, with some

support from analysts, that telecommuni-

cations companies increasingly need mas-

sive scale to succeed.

AT

&

T

and Verizon

have more combined market share now

than they did five years ago, at about 70%.

(

T

-Mobile, with 16%, has gained market

share mostly from Sprint, which has 12%.)

AT

&

T

is trying to buy Time Warner, pend-

inga regulatory challenge (see next article),

in part to better lock in customers. Both

AT

&

T

and Verizon are investing in 5

G

. Mr

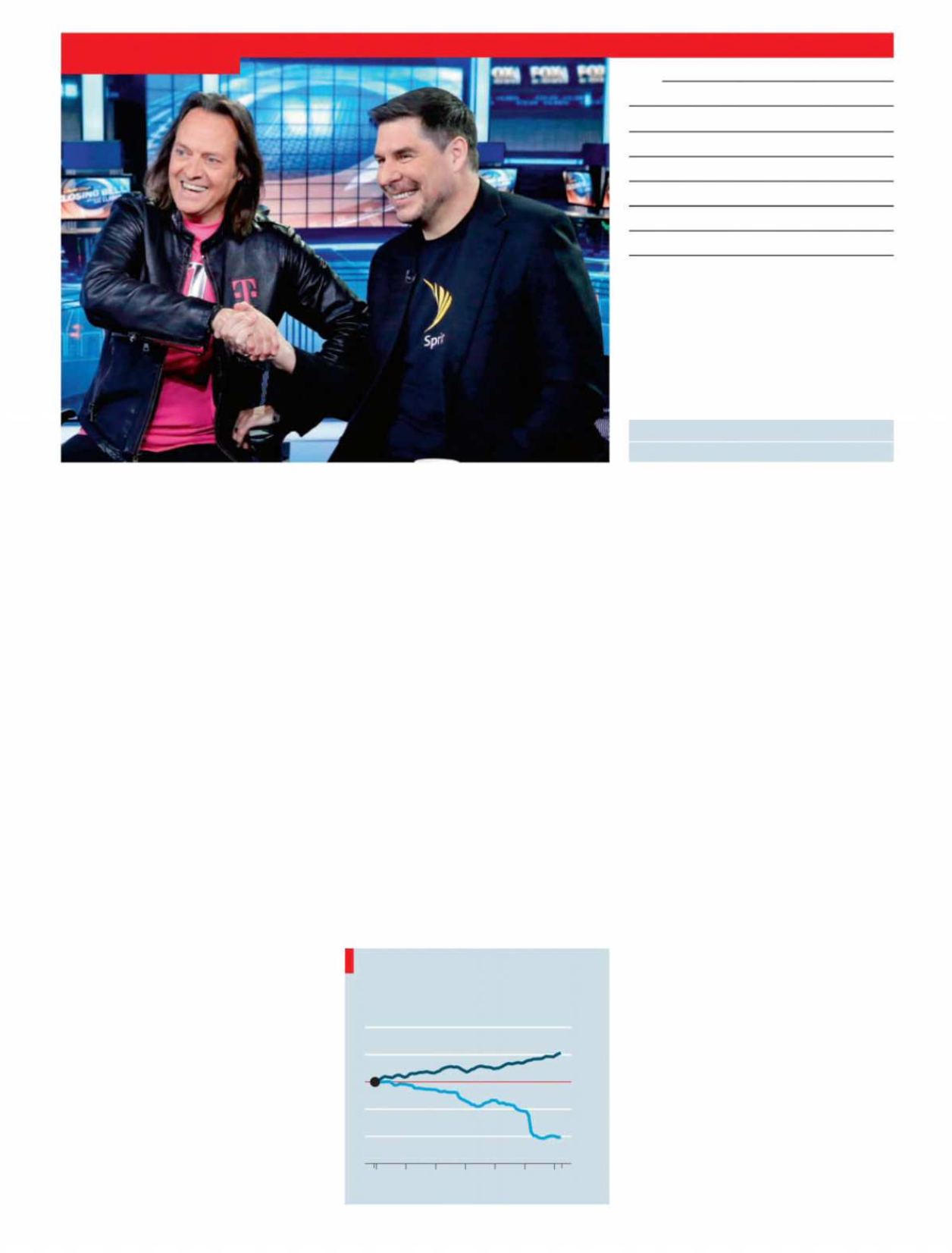

Legere and Marcelo Claure, the boss of

Sprint (pictured above), say that only by

joining up can

T

-Mobile and Sprint com-

pete against the larger firms.

Their claims about 5

G

do contain some

truth. Combined, the two companies own

enough spectrum to cover much of the

countrywith a far zippier network than ei-

ther has now, though not at the fastest

speeds promised with 5

G

. “Sprint is bring-

ing some serious spectrum assets that

T

-

Mobile doesn’t have and really needs bad-

ly for 5

G

,” says Stéphane Téral of

IHS

Mar-

kit, a provider ofmarket and financial data.

The new

T

-Mobile would be better and

stronger, analysts say, but its prices would

probably not be lower. Projections from

T

-

tion of their spectrum assets. Mr Trump’s

administrationhasmade it clear that it cov-

ets early development of a 5

G

network, to

stop China winning the battle over the

technology. In addition, “Trump-led tax re-

form” was “particularly helpful” to the

deal’s economics, cooed Mr Legere. Inves-

tors, worried that Mr Trump’s Department

of Justice will not be so easily charmed,

sold shares in both companies.

The deal represents a big retreat for Ma-

sayoshi Son, boss of SoftBank, which

owns 85% of Sprint. Mr Son engineered a

$20bn takeover of Sprint in 2013, with the

aim ofmerging it with

T

-Mobile, but badly

misjudged the regulatory mood. Twice he

tried and failed tomerge Sprint with

T

-Mo-

American telecoms

The art of the deal

NEW YORK

T-Mobile and Sprintwill find it hard to persuade regulators that theirmergerwill

add jobs and reduce prices

Business

Also in this section

60 AT&T and Time Warner

60 Glencore in the DRC

61 Entrepreneurship in France

62 Trade and American business

63 Alphabet’s designs for Toronto

64 Schumpeter: Attack of the drones

Downwardly T-Mobile

Source: Bureau of Labour Statistics

United States, price indices

December 2011=100

2011 13 14 15 16 17 18

70

80

90

100

110

120

Consumer prices

Wireless telephone services

РЕЛИЗ ПОДГОТОВИЛА ГРУППА "What's News"

VK.COM/WSNWS