The Economist

May 5th 2018

65

For daily analysis and debate on economics, visit

Economist.com/economics1

I

N THE skyscraper that is Bank of Ameri-

ca’s NewYorkheadquarters, the chief ex-

ecutive, Brian Moynihan, looks relaxed.

The bank has just announced record first-

quarter earnings. Its return on equity is

comfortably indouble digits. Its share price

has been on a roll. The revival ofAmerica’s

second-largest bank, he avers, was inevita-

ble. Any darkmoments? None, except per-

haps when America’s sovereign debt was

downgraded in 2011 and all the country’s

banks suffered. Early hints at the current

prosperity? On his first day in the job, in

2010, he says. Vast losses from bad debt

and litigation merely obscured billions of

dollars in operating profits. “We just had to

get rid ofwhat was dragging us down.”

In fact, this renaissance was anything

but predictable. Over littlemore thanhalfa

centuryMr Moynihan’s two predecessors,

Hugh McColl and Ken Lewis, had trans-

formed the tiny North Carolina National

Bank into an institution that could claim a

business relationship with half of all

American households. Any disruption

along the way was dwarfed by the conse-

quences of the final two acquisitions,

Countrywide Financial, a subprime lend-

er, and Merrill Lynch, an investment bank

with underwriting, brokerage and trading

arms. Both imploded during the financial

crisis. Askedwhat madeMrMoynihan the

right person to take over in themidst of the

chaos, the acerbicMr Lewiswas reputed to

have quipped: “Hewanted the job.”

liever. The bank’s shares now trade at130%

of accounting value. The threat of regula-

tory sanctions continues to hangover all fi-

nancial institutions, but Bank of America

has been replaced by Wells Fargo as a fa-

voured target. And it has benefited from

government policies in other ways. The re-

cent cut in corporate taxes lowered its ef-

fective tax rate from 27% to 18%, accounting

for a third of its increased profits. The wide

variety of capital standards to which big

banks must adhere gives a relative advan-

tage to those that have lots of businesses,

and can thus arrange their affairs most effi-

ciently. The crisis-era bail-outs sent the

message that the government regarded the

largest banks as too big to fail. Deposits

have since flooded in (see chart), even

though interest rates have been nugatory,

keeping funding costs down. And the rules

intended to avert future bank failures have

helped big banks see off competition from

smaller ones, since they can spread com-

pliance costs over a larger base.

Mr Moynihan is now hacking away at

anything not directly related to servicing

Bank of America clients. He has got rid of

stakes in Santander, BlackRock, China

Construction Bank and Banco Itaú; credit-

card businesses in Britain, Canada, Ireland

and Spain; and a slew of private-equity in-

vestments. He has kept hubs in London

and Hong Kong for trading and investment

banking, which act as a conduit between

foreign clients andAmerica, andAmerican

clients and the world. But wealth manage-

ment, once offered in 35 countries, is now

offered in just one—America.

Internal restructuring has been un-

relenting. The bank claims to have moved

away from lucrative but risky activities

such as subprime lending for cars, cards

andhomes.WhenMrMoynihan tookover

the top job, 23 kinds of current accounts

were offered. That has been cut to three.

Over the next five years Bank of Ameri-

ca lost $134bn on loans that were repaid

late or not at all and related expenses, and

spent a further $64bn on litigation. Head-

count had peaked at 302,000 in 2009 after

the Merrill purchase; it fell by 100,000 in a

brutal series of redundancies. The number

of branches was slashed from 6,100 in late

2008 to 4,500. For years, the pain seemed

fruitless. As recently as February 2016, its

shares traded at half their accounting val-

ue. Regulations that in effect outlawed ac-

quisitions constrained its opportunities for

growth. Investors had little faith in the

worth of its assets, or indeed in its strategy.

The stockmarket has since become a be-

Bank of America

Dollars and sense

NEW YORK

Asprawling financial empire has found awinning strategy

Finance and economics

Also in this section

66 Reshaping Deutsche Bank

66 China’s effect on innovation

67 The pay premium for education

68 Blackstone’s credit-default swaps

68 Cleaning up tax havens

70 Japan’s overstaffed banks

71 Buttonwood: The next crisis

72 Free exchange: The worth of nations

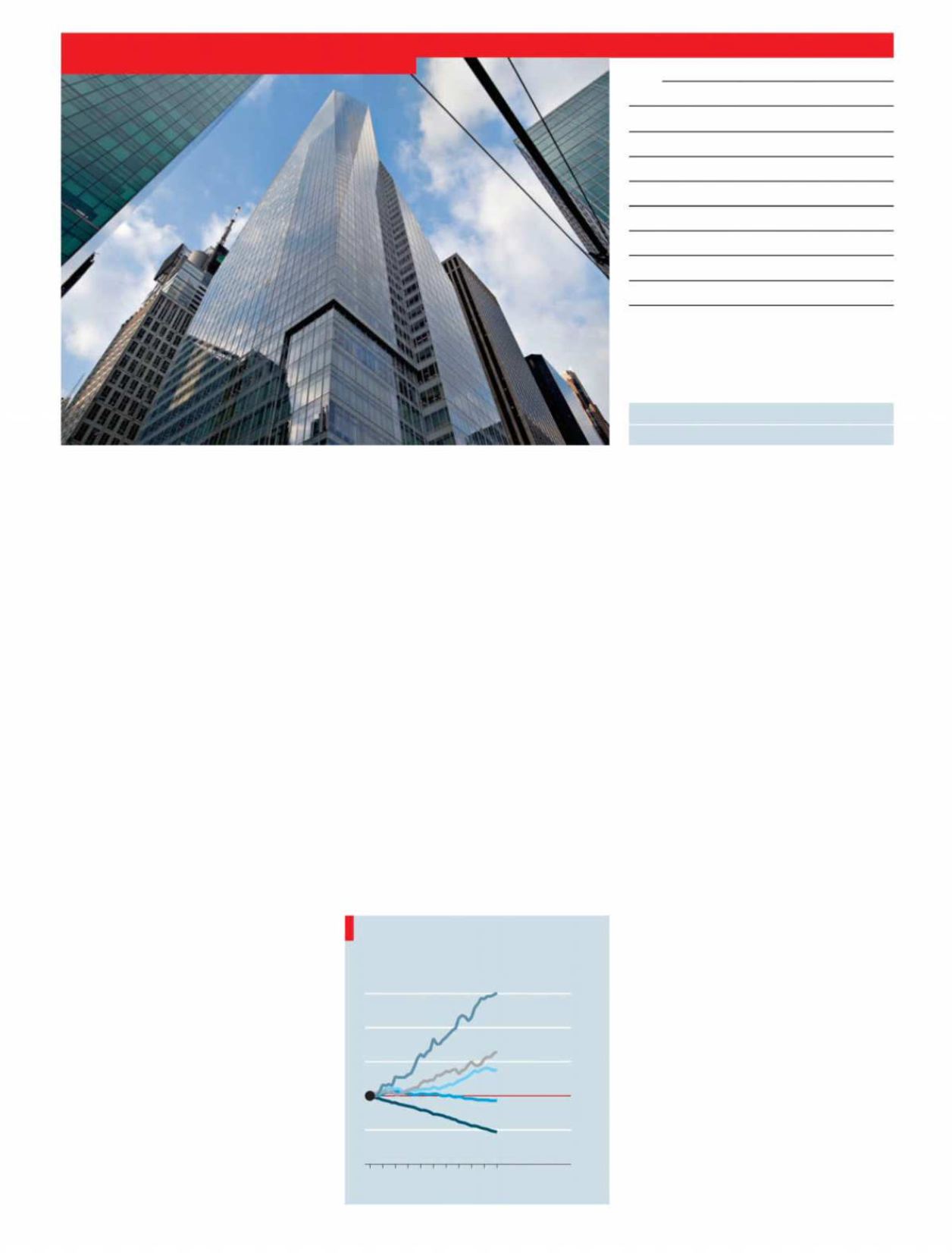

Banking on scale

Source: FDIC

United States, bank domestic deposits

By asset-size group, Q4 2007=100

50

0

100

150

200

250

2008 10 12 14 17 16

Less than

$100m

$100m-1bn

$1bn-10bn

$10bn-250bn

Greater than

$250bn

РЕЛИЗ ПОДГОТОВИЛА ГРУППА "What's News"

VK.COM/WSNWS