70 Finance and economics

The Economist

May 5th 2018

1

2

under which they have been left to shape

their own policies on finance and much

else. Orlando Smith, the

BVI

’s premier,

called it a “ breach of trust” that “calls into

question our very relationship with the

UK

”. His wife, who runs the agency that

promotes the islands’ financial sector, de-

scribed it as “smacking of colonialism”.

In fact, such intervention is not unpre-

cedented. Britain’s government has laid

down the law in its territories on capital

punishment and the criminalisationof ho-

mosexuality. In 2009 it imposed direct rule

on the Turks & Caicos Islands after an in-

quiry uncovered government corruption.

In February, however, it declined to block

legislation in Bermuda that revoked a law

allowing same-sex marriage. A minister

said that such powers “can only be used

where there is a legal or constitutional ba-

sis for doing so, and even then, only in ex-

ceptional circumstances”.

Do the activities of tax havens amount

to such circumstances? The territories

point out that they have improved their

tax-transparency and anti-money-laun-

dering regimes to the point where they are

judged as good as or better than those of

several

OECD

countries, including Ameri-

ca. They have central ownership registers

that can be accessed quickly by British and

other law-enforcement agencies.

They also argue that public registers are

no panacea. Britain’s is in effect an honour

system. The only person prosecuted for

providing false information so far has been

a campaigner who sought to highlight the

lack of checks on submissions by register-

ing a firmcalled afterVince Cable, a former

British minister, and naming him as a di-

rector. The anti-money-laundering stan-

dards set by the Financial Action Task

Force, an intergovernmental body, do not

require registers to be public.

Anti-corruption activists insist that the

rampant use of havens by financial ne’er-

do-wells warrants extraordinary action.

BVI

-registered shell companies, in particu-

lar, crop up frequently in tax-evasion and

corruption cases. Mr Mitchell argues that

public access to registers is important be-

cause resource-constrained law enforce-

ment needs help from

NGO

s and investiga-

tive journalists to “join up the dots”.

With the bit now firmly between their

teeth, anti-corruption types will want

more. Pressure could growfor similar treat-

ment ofBritain’s closer-to-home crown de-

pendencies of Jersey, Guernsey and the

Isle ofMan, though their relationshipwith

Britain is different. They are not former col-

onies, which makes it harder for Parlia-

ment to legislate for them. Geoff Cook of

JerseyFinance, which is part-fundedby the

island’s government and promotes its fi-

nancial centre, says Jerseywill fight to keep

its system of “compliant confidentiality”,

until global standards dictate otherwise.

Another battle looms.

7

S

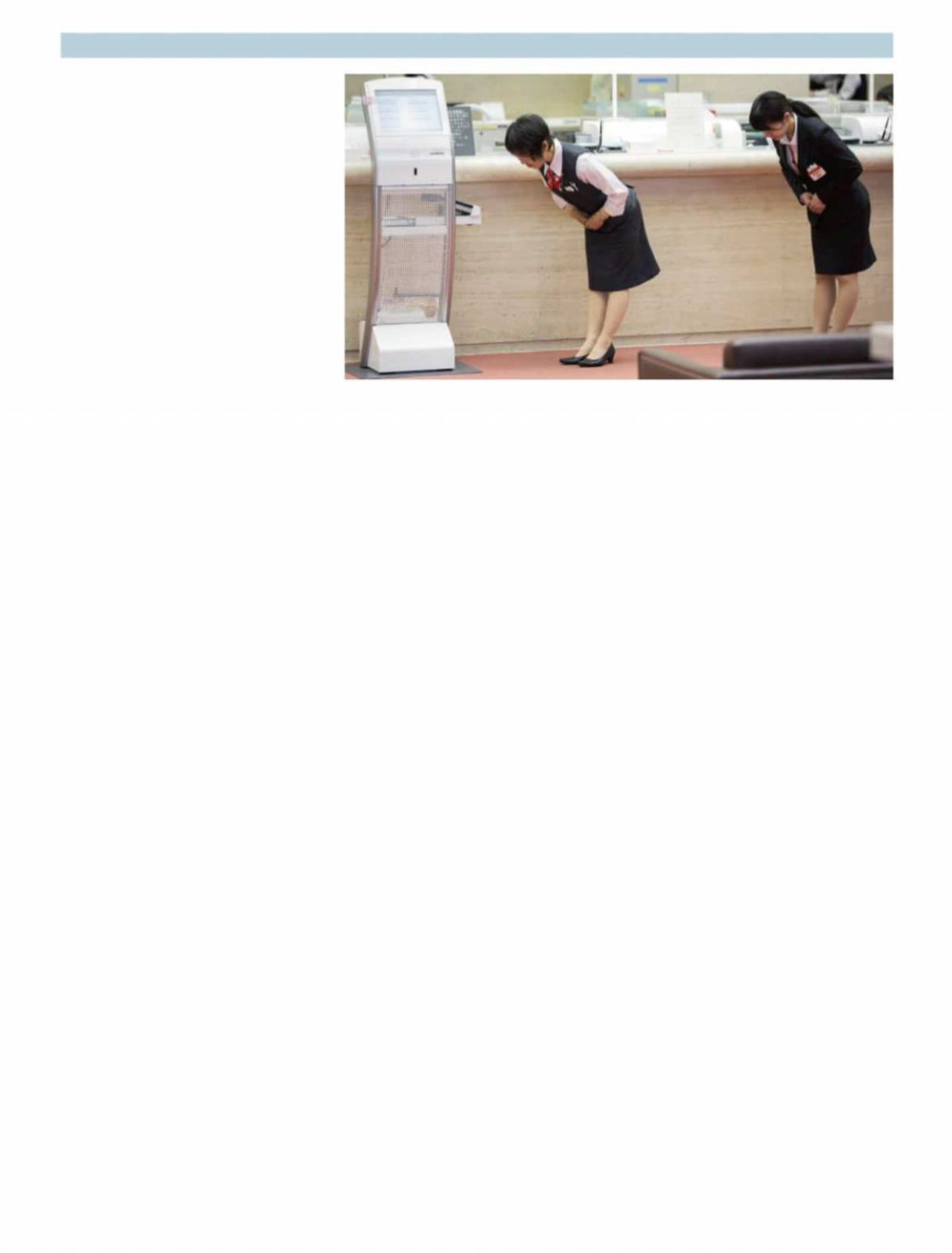

WEEP past the cash machines at the

Sumitomo Mitsui bank in Tokyo’s San-

genjaya shopping district and instead en-

joy the personal service. Uniformed con-

cierges welcome every customer with a

bow. A dozen tellers are watched over by a

manager who leaps up to meet elderly pa-

trons. Transactions are concluded with

carved signature seals stamped on paper

contracts, and another round of bows.

Japan’s high-street banks are not just

overstaffed. They are also overbranched.

According to theWorld Bank, high-income

countries have on average 17.3 commercial-

bank branches per 100,000 adults. Japan

has 34.1. Ifyou include branches ofthe post

office, a popular place for people to save,

the Bank of Japan (

B

o

J

) reckons the coun-

try is theworld’smost overbanked.

Retail banks across most rich countries

struggled to make money after the finan-

cial crisis. But Japan has been close to or in

deflation for most of the past two decades.

The result, according to a report last year by

the

B

o

J

, is “strikingly” low profitability. Re-

turn on assets for the 12 months ending in

March 2017was 0.3%, comparedwith1% for

those in America. “The entire banking sys-

tem has to drastically shrink,” says Nao-

yuki Yoshino of the Asian Development

Bank Institute, a think-tank.

A lingering culture of jobs for life is one

reason it hasn’t done so yet. The nation’s

biggest banks are, however, finally starting

to act. The

IMF

warned last autumn that Ja-

pan’s big three,

MUFG

, Sumitomo Mitsui

and Mizuho, are among nine global banks

that suffer from persistently lowprofitabil-

ity. Last year all three announced the clo-

sure ofhundreds ofbranches and the elim-

inationof32,000 jobsbetween themin the

coming decade. Mizuho will shed a quar-

ter ofitsworkforce.

MUFG

says it expects to

replace thousands of employees by auto-

mating up to 100 of its branches. All that

sends a signal to the rest of the industry,

says ShinobuNakagawa of the

B

o

J

.

The megabanks are well-placed to find

alternative sources of growth by expand-

ing abroad, says Masamichi Adachi of J. P.

Morgan Securities. Reckless lending in Ja-

pan in the1980s and1990swas followedby

a round of mergers. Recapitalisation was

complete by themid-2000s. The resultwas

that big Japanese banks were in a position

to snap up some of the business left be-

hind as American and British banks re-

trenched in Asia after the financial crisis. A

spending spree began in 2012.

MUFG

bought stakes in banks in Vietnam, the

Philippines and Thailand. Since 2012 the

share of foreign loans by the big three has

risen from 19% to 33%. As they retrench at

home, this sharewill probably rise further.

The country’s 105 regional banks are

worse-placed, says Mr Yoshino. Some are

barely profitable and more than half are

losing money on lending and fees. As the

population has shrunk and aged, these

banks’ problems have been exacerbated

by young people moving to the big cities.

Not only is their customer base beingwhit-

tled away, but the customers they are left

with are older people who are most likely

to want personal service. The Fair Trade

Commission, which regulates competi-

tion, has approved 15 regional bank merg-

ers in the past decade and the pace is accel-

Banks in Japan

Silver service

TOKYO

Apainful but essential streamlining has barelybegun

РЕЛИЗ ПОДГОТОВИЛА ГРУППА "What's News"

VK.COM/WSNWS