PERSONAL FINANCE

36

DATA:VISA,MASTERCARD,AMERICAN EXPRESS, JUNIPER RESEARCH, ALIPAY, “MOBILE PAYMENTS&FRAUD”BY KOUNT, THE FRAUD PRACTICE,

CARDNOTPRESENT.COM AND BRAINTREE

Ant Financial’s Alipay and Tencent Holdings

Ltd.’s WeChat Pay together have 90 percent

of the Chinese market. Alipay, with 520 million

users, is making deals with payment processors

in the U.S. as it seeks to follow customers as

they travel. It works in some New York taxis.

Pay Buttons

Spend

China’s

Big

Buttons

When you buy something with your phone

or online, you may see multiple buttons

that allow you to pay with a single click.

The war to be the one button that rules

them all is heating up. —

Jenny Surane

hit Vincent Delisle like a tractor two weeks ago. A

Caterpillar tractor, to be exact. He’d been out west,

meeting with clients of Scotiabank on the morning

of April 24. Caterpillar Inc. shares started of great

that day following stellar earnings—they were up

almost 5 percent. Just as fast, they sputtered and

reversed, ending the day with their worst decline in

two years. Why? Perhaps because the company also

said those earnings “will be the high watermark” for

the year. “You’re getting earnings that are blowing

out estimates and are phenomenal, and the market

is not happy,” Delisle says. “This is an illustration of

when the positive story is all priced in. It’s hard to

do anything to surprise the market.”

The threats all have the same ring: There’s too

much good news, so what if it’s all downhill from

here? Ten-year Treasury yields, stuck below 3 per-

cent for six years, crossed that threshold in late

April and have hopped around it since then. Higher

rates are generally a sign that the economy is

returning to health, but they can also make bonds

a somewhat more attractive alternative to stocks

and mean higher borrowing costs. In the low-rate

environment, companies leveraged up—and the

ones with the most debt are suddenly pariahs with

equity investors.

But here’s the thing: Earnings growth may be

about to slow, but S&P 500 income is still pro-

jected to rise 10 percent in 2019 and 2020. Price-

earnings ratios based on those earnings are

smack in the middle of the historical average.

There’s also no sign companies are getting stin-

gier with share repurchases. “Using a baseball

analogy, we’re in the ninth inning of the bull mar-

ket, but we are dealing with a very bad pitcher,”

says Delisle—meaning this thing could go for a long

time before the bull strikes out. There’s no rule

that says a rally has to end just because it’s been

going for a while.

Individual investors who tuned out the exu-

berance of recent years may want to ignore Wall

Street’s current angst as well. Turns in the mar-

ket are hard to call, and most people are better

of picking a strategy they can stick with through

the ups and downs. But the past few months

are a reminder that owning stocks does require

a little steel. “I try to help clients understand

that this volatility is just part of the game,” says

Peter Waterloo, a senior portfolio manager at

UBS Wealth Management USA. “And the fact that

we had low volatility for a long period is not the

norm.”

—Elena Popina and Sarah Ponczek

THE BOTTOM LINE Corporate America has been turning in

terrific earnings, but the market is focused on rising interest rates

and the return of volatility.

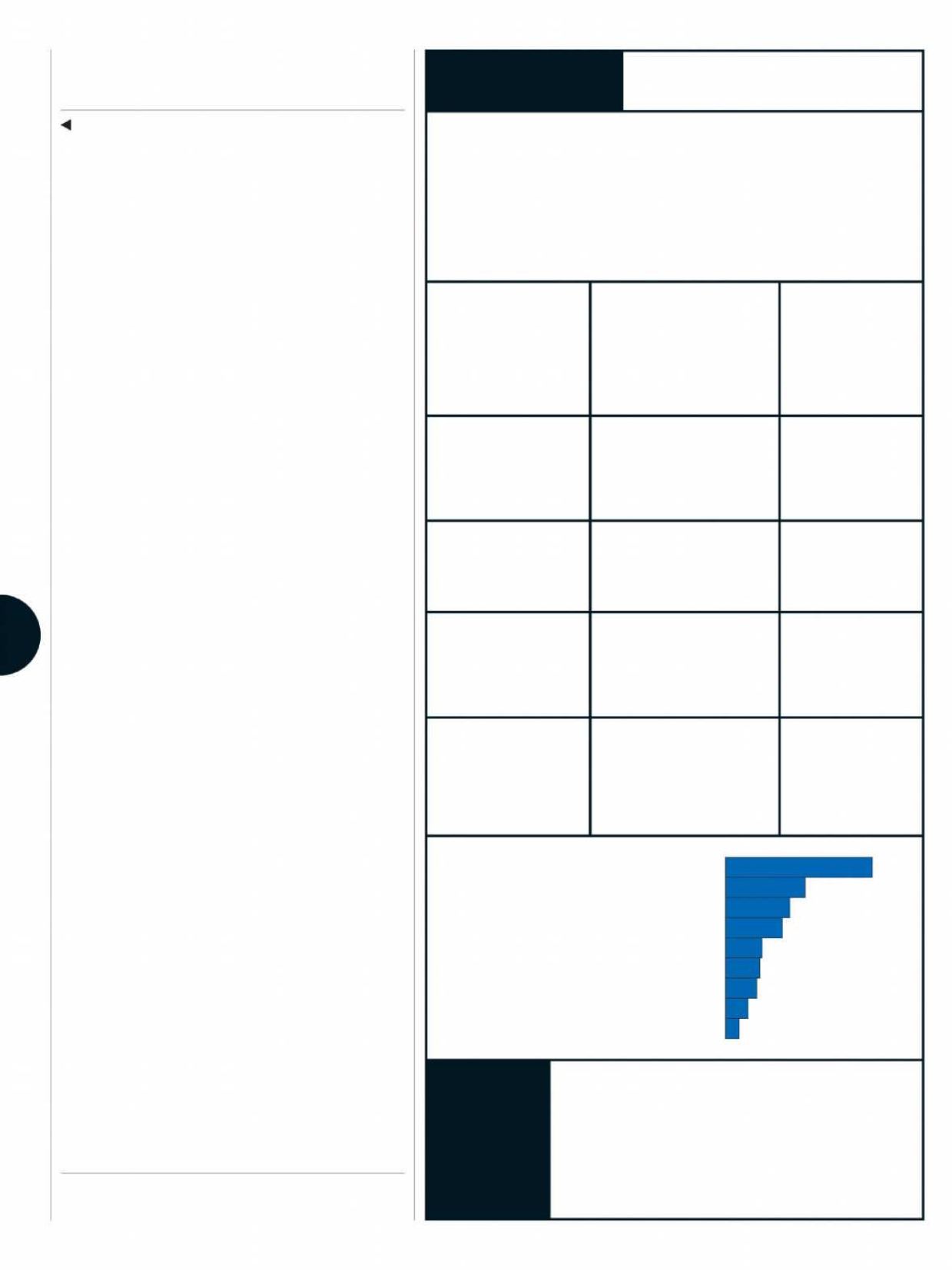

Share of

merchants

accepting

mobile wallets

(among those

who accept

at least one)

Visa Checkout,

Masterpass,

AmEx Express

Checkout

Apple Pay

PayPal

Chase Pay

Amazon Pay

These are run by the

big card networks. But they

want to reduce the button

clutter. Along with Discover

Financial Services,

they plan to create a single

service, yet to be named.

Its edge is the iPhone.

Users load their cards into

a digital wallet and

use Touch ID or Face ID to

authenticate purchases.

The one to beat in the U.S.

It has the most accounts

globally and is accepted by

the most merchants.

Promises to be a lower-

cost option for merchants,

which pay fees on digital

transactions. It works only

with Chase Visa cards.

Lets shoppers on other sites

pay with their

Amazon.comaccounts. To entice retailers,

the e-commerce giant

will pass along the discounts

it gets on credit card fees.

129m

combined users

86m

users

237m

users

28m

users

33m

users

PayPal

Apple Pay

Visa Checkout

Android Pay

AmEx Express Checkout

Masterpass

Samsung Pay

Alipay

Chase Pay

64%

16%

28%

14%

35%

15%

25%

10%

6%