ECONOMICS

Bloomberg Businessweek

May 14, 2018

39

“few or no” qualiied workers for job openings. Yet

on May 8 the NFIB reported that in April the net

percentage of small-business owners who reported

improved earnings trends was the highest in the

survey’s history. “There is no question that small

business is booming,” William Dunkelberg, NFIB’s

chief economist, said in a statement. (Big compa-

nies are, too: First-quarter earnings for companies

in the S&P 500 are expected to be 24 percent higher

than a year earlier, Bloomberg calculated on May 9.)

Sectors with strong pay growth generally con-

front special circumstances. Those truck drivers

being ofered as much as $150,000? They’re being

hired by oil producers in the Permian Basin who are

desperate to get their crude to market. Hospitals,

whose median expenditures for contract labor rose

19 percent in the past year, face their own special

problems, according to John Morrow, a managing

director of Franklin Trust Ratings who analyzes hos-

pitals. People whose skills are in high demand and

work under temporary contract rather than sal-

ary can take full advantage of shortages for their

talents, according to Morrow. “This is a level of skill

that requires advanced-level training that involves

medicine, technology, and science, and all of those

things are costly,” he says.

An important sign that rising costs remain man-

ageable is that most companies haven’t passed

them along to customers. Walmart Inc., the nation’s

largest private employer, raised starting wages

to $11 an hour in January and announced annual

bonuses of as much as $1,000. But it’s cutting prices

to remain competitive with

Amazon.comInc. and

low-cost supermarket chains Aldi Inc. and Lidl

US LLC. The same goes for packaged-goods com-

panies. General Mills Inc. has acknowledged that

attempts to hike prices for its Progresso soup and

Yoplait yogurt ultimately hurt sales by driving shop-

pers to other brands. In freight transportation,

BNSF Railway Co. has picked up market share from

Union Paciic Corp. by underpricing it.

“We have to be a little bit cautious in infer-

ring that wage growth is going to be a major con-

straint for business,” says Gregory Daco, head of

U.S. macroeconomics for Oxford Economics Ltd.

While some economists warn that rising inlation

is a “late-cycle” phenomenon—i.e., a precursor

of recession—“we don’t have clear evidence that

we’re at the end rather than the middle of the

cycle,” says Michael Englund, chief economist of

Action Economics LLC in Boulder, Colo.

A key statistic to watch is unit labor costs, which

are wages adjusted for productivity. They rose at an

annual rate of 2.7 percent in the irst quarter. But

over the past year as a whole, the increase was only

1.1 percent. As long as companies’ unit labor costs

don’t rise faster than the prices they charge, tight

labor markets won’t be a problem.

…

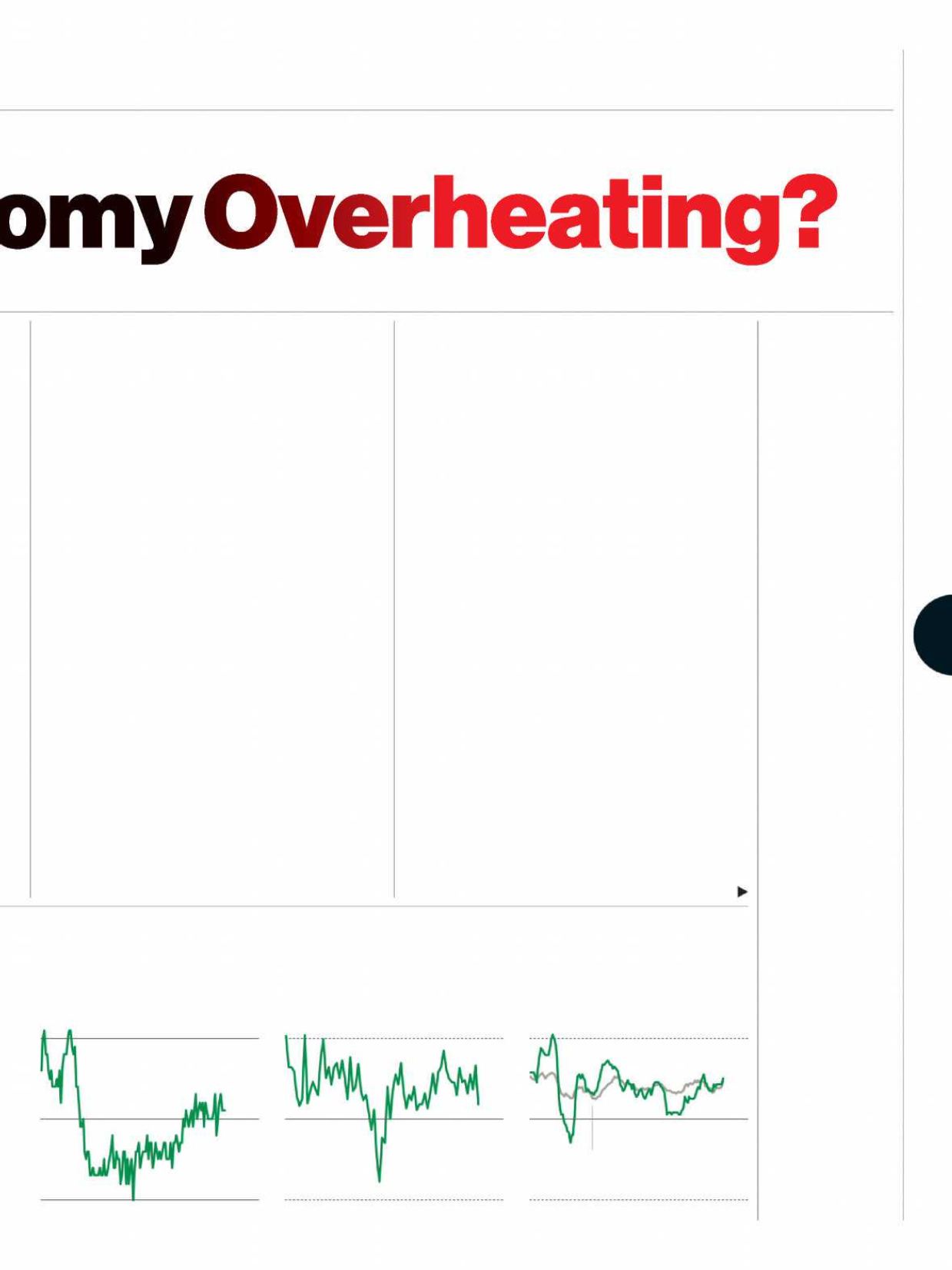

But They Aren’t Fueling Inflation Yet

Annual growth in average hourly earnings

remains modest.

Consumer spending growth

, adjusted for

inflation, is weak.

The Fed’s favorite

measure of inflation

has

just reached its target.

3.5%

2.5

1.5

4%

0

6%

0

-6

4/2007

4/2018

2Q '07

1Q '18

4/2007

3/2018

-4

Excluding food and energy

DATA:BUREAU OF LABOR STATISTICS, NATIONAL FEDERATION OF INDEPENDENT BUSINESS, INSTITUTE FOR SUPPLY MANAGEMENT DIFFUSION INDEX ON

BUSINESS BACKLOG OF ORDERS,BUREAU OF ECONOMIC ANALYSIS’S MEASURE OF PERSONAL CONSUMPTION EXPENDITURES AND RELATED PRICE INDEXES