ECONOMICS

Bloomberg Businessweek

May 14, 2018

40

VLADIMIR GRIGOREV/ALAMY

○ The return of U.S. sanctions will solidify China’s hold over the Middle East’s second-largest economy

Iran’s New

BFF

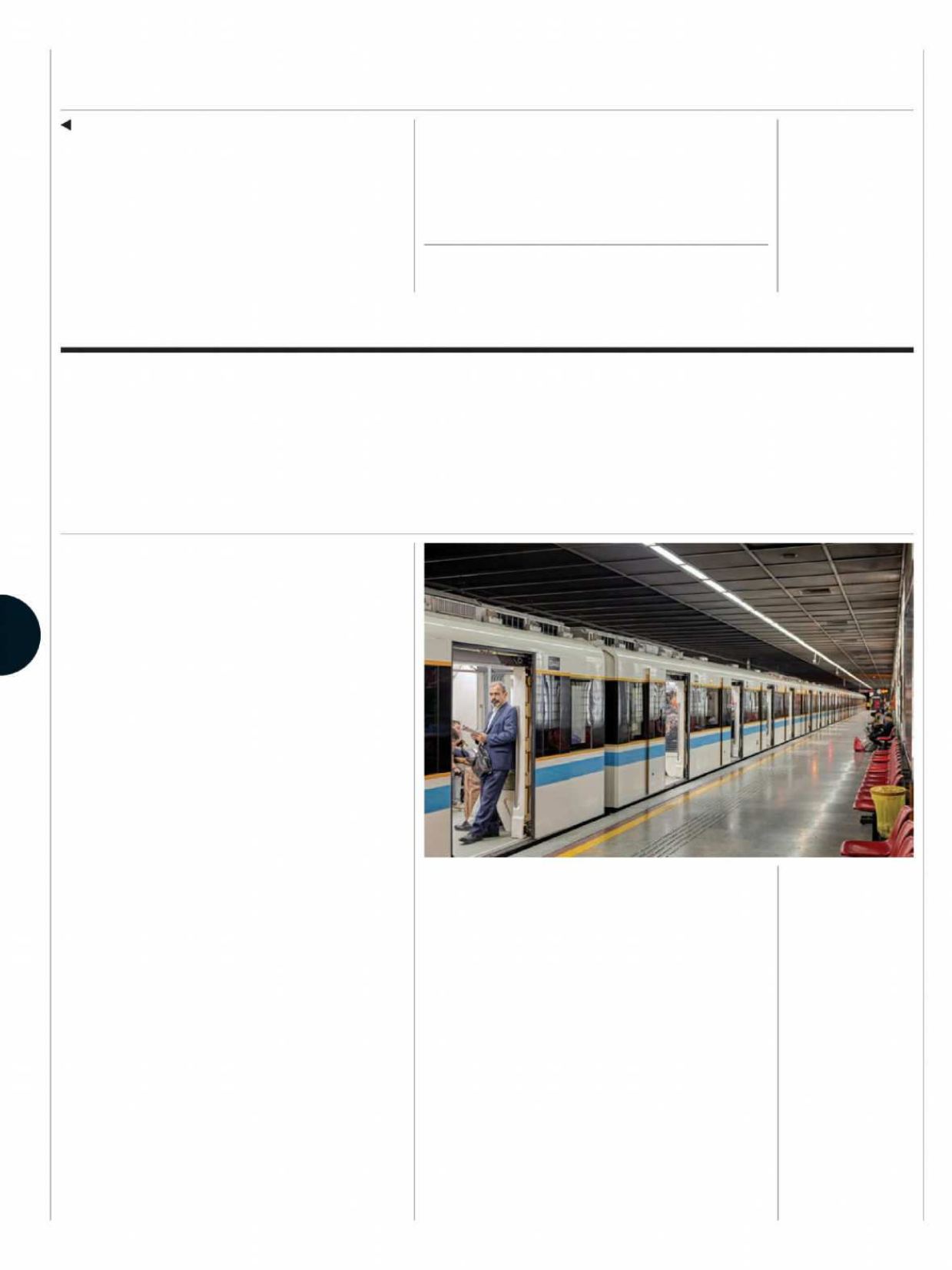

Tehran traic is gridlocked half the time, and the

city spends most of the year engulfed in smog,

so it’s no surprise that locals travel underground

when they can—on a metro system that carries as

many as 2 million riders a day. During the decade

when international sanctions were in place, efec-

tively turning Iran into a no-go zone for Western

companies, the capital’s authorities managed to

steadily expand the network, roughly doubling its

size. It wasn’t easy. Often “the parts we needed,

we had to build ourselves,” says Ali Abdollahpour,

deputy managing director of the Tehran Urban &

Suburban Railway Operation Co.

A constant of those years was Chinese help with

everything from building rails to making subway

cars. The 2015 multicountry agreement to moth-

ball Iran’s nuclear program, and lifting of the most

punishing sanctions a year later, were supposed to

broaden Abdollahpour’s options. He had his eyes on

Europe—“their tech is better”—for essential braking

and signaling systems. Yet when the metro launched

a tender for more than 600 wagons, the contract

went to a unit of China’s CRRC Corp., which beat

out two European rivals for a deal valued at more

than $900 million, according to local press reports.

The tender is part of a pattern where European

companies have been edged out of a coveted

emerging market by Chinese competitors. Iran’s

trade with China climbed from $12.5 billion in

2006 to $27.9 billion last year. Italy, France, and

Germany all saw their commerce with the Middle

East’s second-biggest economy, after Saudi Arabia,

shrink in the same period. Data on foreign direct

investment in Iran are harder to come by, but

The Fed’s preferred measure of inlation,

the price index for personal consumption expen-

ditures, is going to look high for a few months

because a brief dip in prices for clothing, hotel

rooms, airline fares, and other items has ended,

says Ian Shepherdson, chief economist of Pantheon

Macroeconomics. That might inluence the Fed, he

says. There’s a risk that Fed rate setters could react

too quickly to signs of overheating. “As inlation

climbs, so too will the risk of recession, because

at some point policymakers will feel impelled to

respond,” Ellen Zentner, chief U.S. economist of

Morgan Stanley, wrote in a note to clients on May 2.

—Peter Coy, with Katia Dmitrieva, Tatiana Darie,

Craig Giammona, and Jamie Butters

experts say they’d likely show a similar trend.

The bonds between Iran and China will only

strengthen following President Trump’s May 8

announcement that the U.S. will withdraw from

the seven-nation nuclear agreement and reintro-

duce sanctions. Chinese investors “have the con-

tacts, the guys on the ground, the links to the local

banks,” says Dina Esfandiary, a fellow at the Centre

for Science and Security Studies at King’s College

London and co-author of the forthcoming book

Triple Axis: Iran’s Relations With Russia and China

.

During a 2016 trip to Europe that included

stops in Paris and Rome, Iran’s president, Hassan

Rouhani, and a delegation of Iranian business

executives signed memorandums of understand-

ing worth almost

€

50 billion ($59 billion). But

most of the promised investment never material-

ized, in part because the U.S. continued to enforce

THE BOTTOM LINE While the job market is tight and the costs

of some widely used commodities such as oil and steel are rising,

companies are largely holding the line on prices.

China has been a

key supplier for the

Tehran Metro