E

C

O

N

O

M

I

C

S

38

May 14, 2018

Edited by

Cristina Lindblad

Businessweek.com○ Some indicators are flashing

red, but there’s still a little slack

in the system

Want ads for truck drivers to haul crude oil in Texas

are touting salaries as high as $150,000 a year. Some

nurses are getting $25,000 signing bonuses. The

U.S. unemployment rate just fell to 3.9 percent,

one tick away from its lowest since the 1960s. And

on May 8 the Bureau of Labor Statistics reported

there are 6.5 million unilled jobs in the U.S., the

most on record. Some employers say they’re

feeling the squeeze. “Rising labor costs remain the

primary contributing factor to our margin erosion,”

Chatham Lodging Trust, a company in West Palm

Beach (Fla.) that owns more than 130 hotels either

by itself or in joint ventures, said on May 1.

Is the U.S. economy overheating? Yes and no.

There are plenty of inlationary bottlenecks, and

not only in the labor market. Backlogs of orders

are the highest since 2004, according to the

Institute for Supply Management. Transportation

costs have jumped in part because of driver

shortages. Strong U.S. oil and gas production has

helped push up the prices of essential inputs such

as steel pipe and specialty sands used in fracking.

On the other hand, the bottlenecks aren’t yet

causing high inlation across the economy, which

would require the Federal Reserve to speed up its

interest rate hikes. The U.S. central bank passed

up the opportunity to raise the federal funds rate

at its May 1-2 meeting while noting that the rate of

inlation has “moved close” to the bank’s 2 percent

target. “In my judgment, the Fed is ready to accel-

erate [rate hikes] if they need to, but they’re not

getting ahead, which I think is appropriate,” says

Josh Wright, chief economist at ICIMS Inc., which

makes software to ind and hire talent.

Some of the factors driving up the U.S. inlation

rate—in particular, the jump in crude oil prices to

about $70 a barrel from less than $50 a year ago—

have external causes and don’t relect overheat-

ing in the domestic economy. Rising commodity

prices caused in part by new steel tariffs cost

General Motors Co. and Fiat Chrysler Automobiles

NV at least $200 million each in the irst quarter.

Tarifs have also helped drive lumber prices to a

record. Other external factors are the high price

of imported alumina for aluminum smelters and

the weather-related runup in prices of vanilla from

Madagascar and cocoa from Ivory Coast and Ghana.

The U.S. economy performed below capacity for

so long that it can be hard for managers to remem-

ber how to operate without lots of spare resources.

Half of the surveyed members of the National

Federation of Independent Business say there are

CONTENTS

○ Trump drives Iran

deeper into China’s

embrace

○ Privatization is no

longer a dirty word

in Brazil

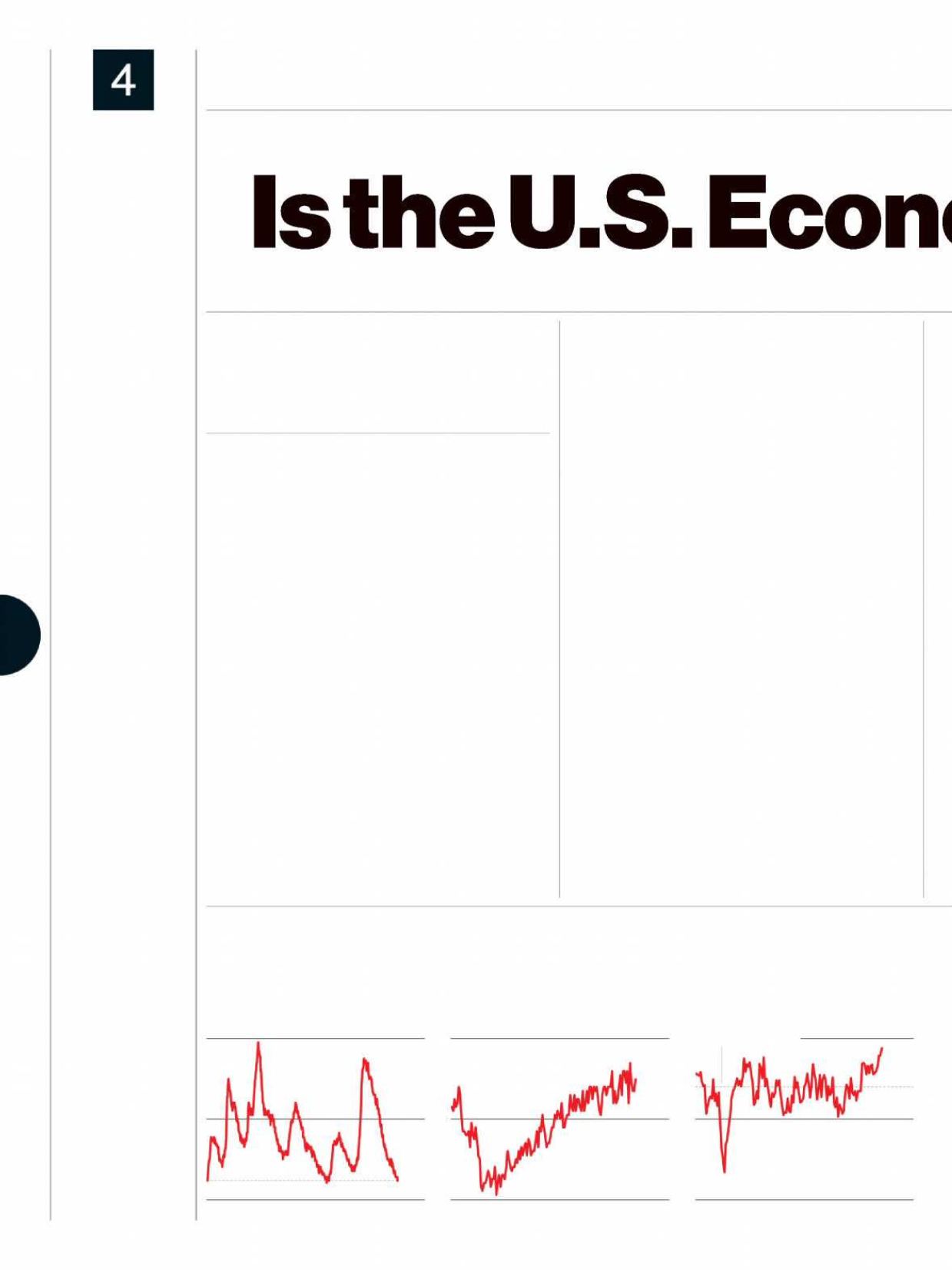

Bottlenecks Are Emerging…

The

unemployment rate

has been lower

than this just once since 1970.

The

share of small-business owners

reporting few or no qualified job applicants

has climbed.

A measure of the

backlog of orders

is at its

highest point in 14 years.

60%

40

20

65%

40

15

1/1970

4/2018

4/2007

4/2018

4/2007

4/2018

Current rate

11%

7

3

Backlog increasing