8

The Economist

May 5th 2018

SPECIAL REPORT

FINANCIAL INCLUSION

2

1

technology.WesternUnion, the giant incumbent ofthe global re-

mittances industry, is also experimentingwith it.

This business, a lifeline for tens of millions of the world’s

poor, has long seemed ripe for digital disruption. As migration

continued to climb, global remittance flows to developing coun-

tries in 2017 reached about $466bn (see chart), around three

times as much as flows of development aid. In Pakistan, for ex-

ample, remittances last year were worth about $20bn, not much

less than all the country’smerchandise exports. InDecember the

central bank launched an initiative to promote the use of e-wal-

lets for cheaper remittances. For now, they are expensive. The fee

for sending $200 is about 7.2%, or as much as 9.1% if the money is

going to Sub-Saharan Africa (and that ignores the exchange rate).

The

UN

’s Sustainable Development Goals include a target of cut-

ting such fees to 3%. AWorldBankreport blames high costs on ex-

clusive arrangements betweenmoney-transfer firms andnation-

al post offices, and on “derisking” by banks scared of infringing

anti-money-laundering and know-your-customer regulations.

Money-transfer operators point out that they also incur

heavy costs. They have to “pre-fund” transfers, leaving money

sitting in destination countries to enable prompt settlement. Rip-

ple cites an estimate of $27trn for the size of this global float. And

operators need a physical presence at both ends. Western Union

has more than 550,000 outlets, covering every country in the

world bar Iran andNorth Korea.

Taking a shot at Goliath

But this business, too, is going digital. The fintechs have tak-

en aim at Western Union’s market, not least to exploit cost sav-

ings from the growth of mobile money. One, London-based

TransferWise, boasts that its charges are just one-eighth of the

banks’ because it offers a “true” exchange rate. Another firm,

MoneyGramofAmerica, accepted an offer of $1.2bn fromAnt Fi-

nancial, but in January the salewas blockedonnational-security

grounds by America’s watchdog, the Committee on Foreign In-

vestment in the

US

. Another firm, WorldRemit, also offers lower

fees thanWestern Union, partly because its model is “100% digi-

tal in”, which means it will not accept any cash. More than one-

third of its global transfers are tomobile-money services.

Meanwhile Western Union is rebranding itself as a digital

company, says Stanley Yung, its chief customer officer. Its rev-

enue from digital money transfers increased by 23% in 2017, to

over $400m. As its competitors sourly point out, finance is a no-

toriously sticky business. Just as fewpeople move their bank ac-

counts, so customers are reluctant to forsake a money-transfer

system that hasworked for them, even if it charges steep fees.

7

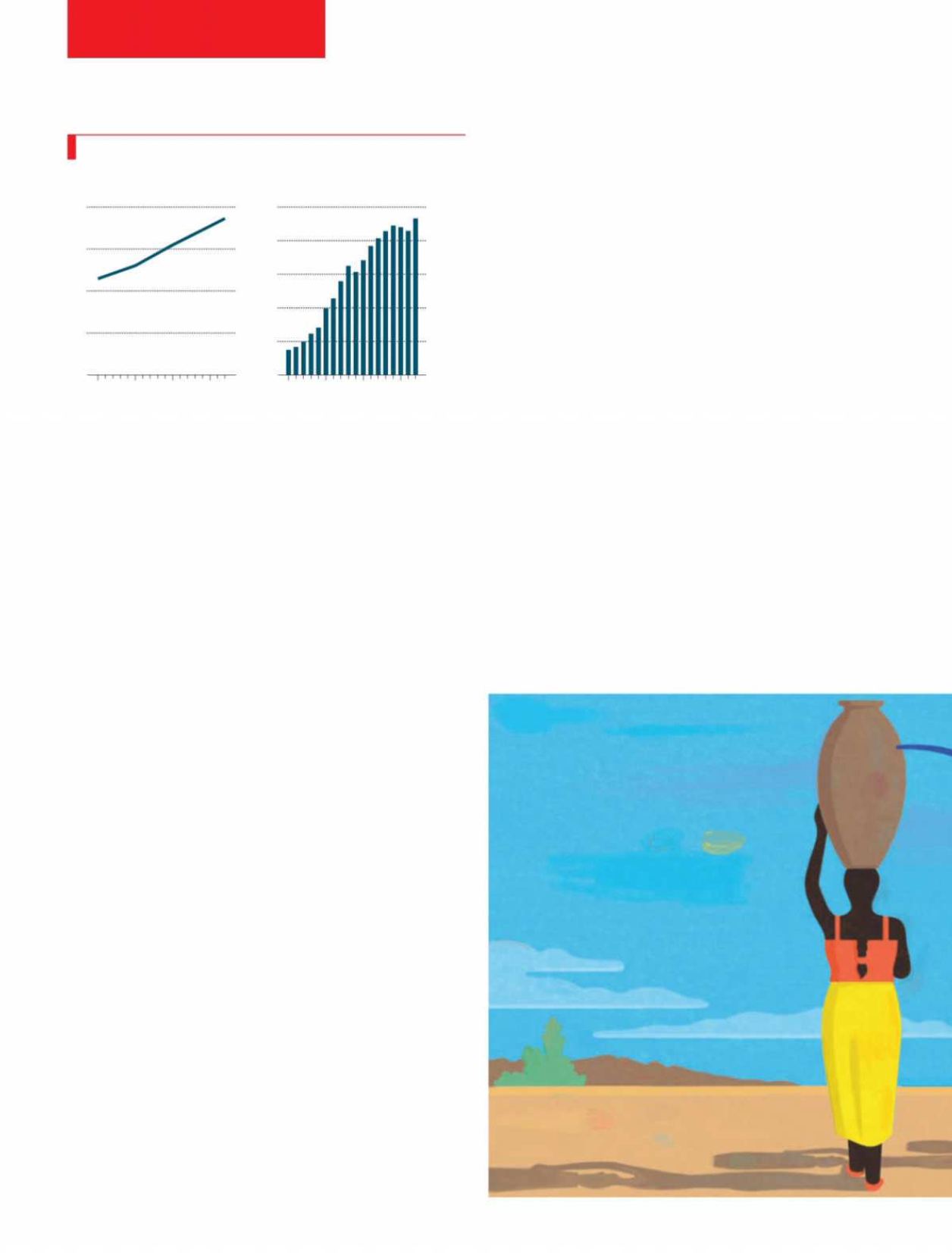

Plenty more where that came from

Sources: UN; World Bank

Global remittances

To developing countries, $bn

Global stock of migrants

From developing countries, m

0

50

100

150

200

2000 05

10 15 17

0

100

200

300

400

500

2000 05

10 15 17

KAUSARPARVEEN, ofChakwal district in the northof Paki-

stan’s Punjab province, is a star beneficiary of the work of

Karandaaz, a Pakistani financial-inclusion charity. The owner of

just onebuffalo, sheborrowed 75,000 rupees (about $650) tobuy

another one and started selling milk. The business has done so

well she now has four buffaloes and an assistant, and has taken

out another loan to install a biogas plant, savingon firewood and

sparing her family thewoodsmoke.

Thiswas howmicrocredit, as promotedbyMuhammadYu-

nus, a Nobel-prizewinning entrepreneur from Bangladesh who

launchedhisGrameenbankin1983, was supposed towork: cred-

it would allow the poor to establish microbusinesses and im-

prove their lives. The idea has spread across the developing

world. Sadly, inmanyplaces it has notworked out thatway. Abig

expansion of microcredit in India’s Andhra Pradesh province

caused a crisis in 2010 when the lenders were blamed for an in-

crease in suicides by farmers. A World Bank paper last Novem-

ber, written byRobert Cull ofthe bankand JonathanMorduch of

New York University, considered evidence showing that micro-

credit has had “only modest average impacts on customers”. It

has often been used to cover the normal ups and downs of

household spending, which is helpful but not transformative.

Mobile financial services

Pocket banking

Mobi

l

emoney means mo

r

e nimb

l

e financia

l

se

r

vices

РЕЛИЗ ПОДГОТОВИЛА ГРУППА "What's News"

VK.COM/WSNWS