FINANCE

Bloomberg Businessweek

October 8, 2018

35

*INCLUDES PLATFORMS THAT HAVE BEEN UNABLE TO REPAY INVESTORS, COME UNDER POLICE INVESTIGATION, HALTED OPERATIONS, TRANSFORMED INTO OTHER

BUSINESSES, OR HAD OPERATORS FLEE WITH CLIENT FUNDS;

†

THROUGH JUNE; DATA: YINGCAN GROUP

THE BOTTOM LINE P2P lenders took of in China after it became

more

diicult to get bank loans. But the high rates they appeared to

ofer savers came with risk—including, in some cases, fraud.

amazing how quickly it’s unraveling,” says Zennon

Kapron, managing director of Shanghai-based con-

sulting irm Kapronasia. “We’re just at the start of

what could be a very messy reconciliation in the

P2P industry.”

Peer-to-peer lending in the U.S., by irms such as

Prosper Marketplace Inc. and LendingClub Corp.,

is but a drop in the American investment ocean. In

China, it has attracted 50 million savers—more than

the populations of New York state and Texas com-

bined—who have sought returns of 10 percent or

more, double what they can get from a bank. The

total investment amount outstanding soared to a

record $200 billion in June.

The government has been seeking to increase

control over what has been a largely unregulated

business, one part of a vast collection of inancial

companies outside the traditional banking sector

known as shadow banks. Earlier in the summer, the

agency that regulates banking warned savers using

P2P sites that they should be prepared to lose all

of their money. Although not all troubled P2P plat-

forms are accused of fraud, oicials have said many

failed sites needed cash coming in to pay money

out; in other words, they were Ponzi schemes.

Other sites attracted investors for only a few weeks

before the owner ran away with the money.

Online lending became popular in China after a

tightening of bank credit in 2010 followed two years

of stimulus spending to counter the global inancial

crisis. In 2012, total loan volume was less than $1 bil-

lion. Then, you could easily ind a young couple

looking for others to invest in their wedding: Lend

themmoney now for their banquet and honeymoon

down payments, and they’ll pay you back with inter-

est after they collect wedding gifts of cash. Small

businesses sought loans to buy new machinery,

pledging to pay back when production increased.

These days, P2P sites ofer investments in what

are called commercial bills, or “bankers’ accep-

tances,” which are like short-term bonds issued

by small businesses. Such bills, issued by compa-

nies and guaranteed by commercial banks, are usu-

ally part of business transactions, and a bill can be

sold to another inancial institution or to the cen-

tral bank before it matures. In some cases involv-

ing allegedly fraudulent P2P platforms, investors

have claimed that the underlying bills didn’t exist

and the money never went where it was intended.

“The risks on a lot of these platforms were not ade-

quately communicated to investors,” says Kapron,

who cites “guaranteed return plus principal” as the

typical ofer to investors. “It was unsustainable.”

That was the case with Quark Finance, which

collapsed on Aug. 25. Shanghai police said the

founder turned himself in and confessed that he

had been siphoning deposits illegally. The com-

pany had $556 million of outstanding unpaid

loans as of July, while cumulative transactions on

the platform totaled $2.3 billion. A statement on

its website said the company has been cooperating

with the investigation. Police said they were call-

ing on victims to report to local authorities and to

refrain from gathering in protest.

As PPMiao began to fail this summer, it changed

its legal address from Hangzhou, a city near

Shanghai, to a residential development in Nanning,

900 miles away, close to the Vietnam border. On

Aug. 6, it stopped paying investors and announced

it was closing because of a run on the platform. It

said it planned to repay investors over the next three

years. “We tried our best, to little avail,” PPMiao

said in the statement. “We promise we won’t run

away, we won’t become unreachable, we will get

our money back to repay investors batch by batch.”

Some investors who were owed less than $1,500

have since been reimbursed. Calls from Bloomberg

to the contact numbers listed on the statement went

directly to voicemail and weren’t returned.

The Chens, who traveled to Shanghai that

month to protest after investing a total of $23,000

of their and their families’ money, had irst gone to

Hangzhou, where they were intercepted by police

who told them the case was being investigated

and they would have to wait. They then went to

Shanghai to protest at the oice of an asset manage-

ment unit of HuaAn Fund Management Co., which

they and other investors believed to be one of three

companies that owned PPMiao. HuaAn is a private

company, but some of its biggest shareholders are

state-owned entities.

HuaAn issued a statement on the day of the

would-be protest saying it had invested in the com-

pany that owned PPMiao on behalf of an asset man-

agement client. It also said later that neither this

company nor the client had disclosed its links to

the P2P lender. HuaAn “is deeply sympathetic of

all the victims and will actively work with police on

any investigation,” the statement said.

For the woman from Zhejiang, whose family

couldn’t be reached to verify her name and details

of her story, those promises were too little, too

late. “Don’t be sad,” she wrote in her note to her

parents. “I am leaving, but your lives need to con-

tinue. I just lost conidence in life in this society. I

am not afraid of death, but I am afraid of living.”

—Bloomberg News

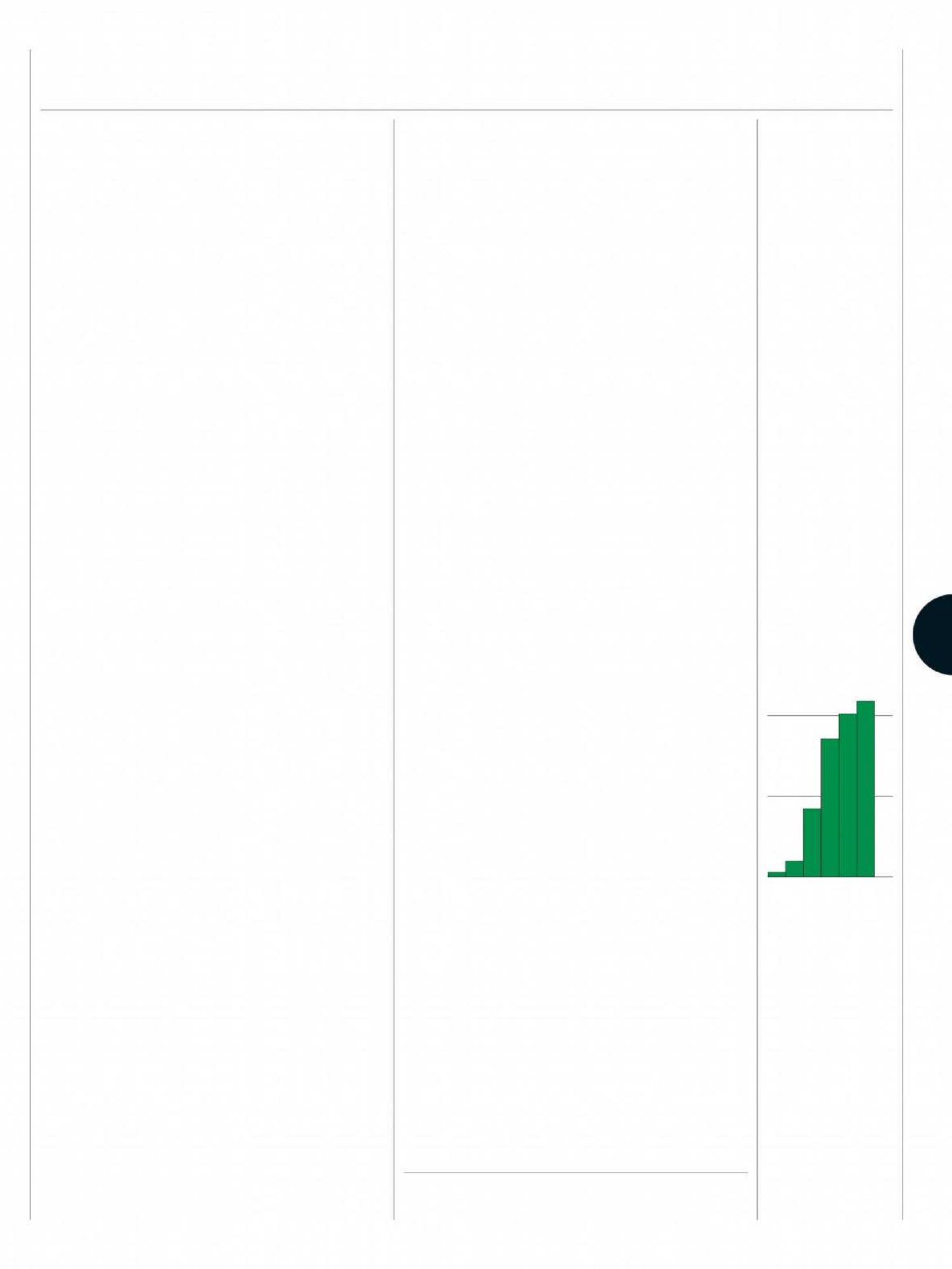

○ Cumulative failed*

peer-to-peer lending

platforms in China

2013

2018

†

4k

2

0