ECONOMICS

Bloomberg Businessweek

October 8, 2018

39

BEN NELMS/BLOOMBERG; DATA: COMPILED BY BLOOMBERG

1/4/16 10/1/18

$40

20

0

○ Price premium per

barrel of benchmark U.S.

crude oil over Canadian

crude oil

“It’s a great tragedy that in this environment

where the commodity demand continues to grow

unabated, Canada is missing out,” says Pourbaix.

The industry has waged a yearslong battle

to add transport capacity with not much suc-

cess. The most visible symbol of this strug-

gle is Keystone XL: President Barack Obama

rejected the $8 billion project, bowing to pres-

sure from environmental groups and indigenous

communities on the pipeline’s path. TransCanada

Corp. won approval from the Trump administra-

tion last year, but construction may not start until

next year—about a decade after the project was

irst proposed.

Pipelines that don’t stray outside Canada’s

borders—like Trans Mountain—have also run into

opposition. The proposed Northern Gateway

line, which, similar to Trans Mountain, would

have carried crude to a shipping terminal on the

Paciic coast, was halted by Prime Minister Justin

Trudeau’s government in 2016. And TransCanada

pulled the plug on its proposed Energy East line last

year after pushback from green groups in Quebec.

Strangled by the pipeline shortage, the price of

Canadian crude has climbed less than 5 percent in

the past two years, compared with 57 percent for

the U.S. benchmark. The $39-a-barrel discount to

the U.S. price on Oct. 1 is near the widest it’s been in

about ive years. (It also relects that Canada’s heavy

grade of crude costs more to process.)

Lower prices represent a missed opportunity

for Canada, whose economy depends heavily on

the oil and gas industry. U.S. crude production

has more than doubled in the past decade, from

about 5 million barrels a day to more than 10 mil-

lion this year. In Canada, output has climbed a

more modest 64 percent, to 4.46 million barrels,

over the same period.

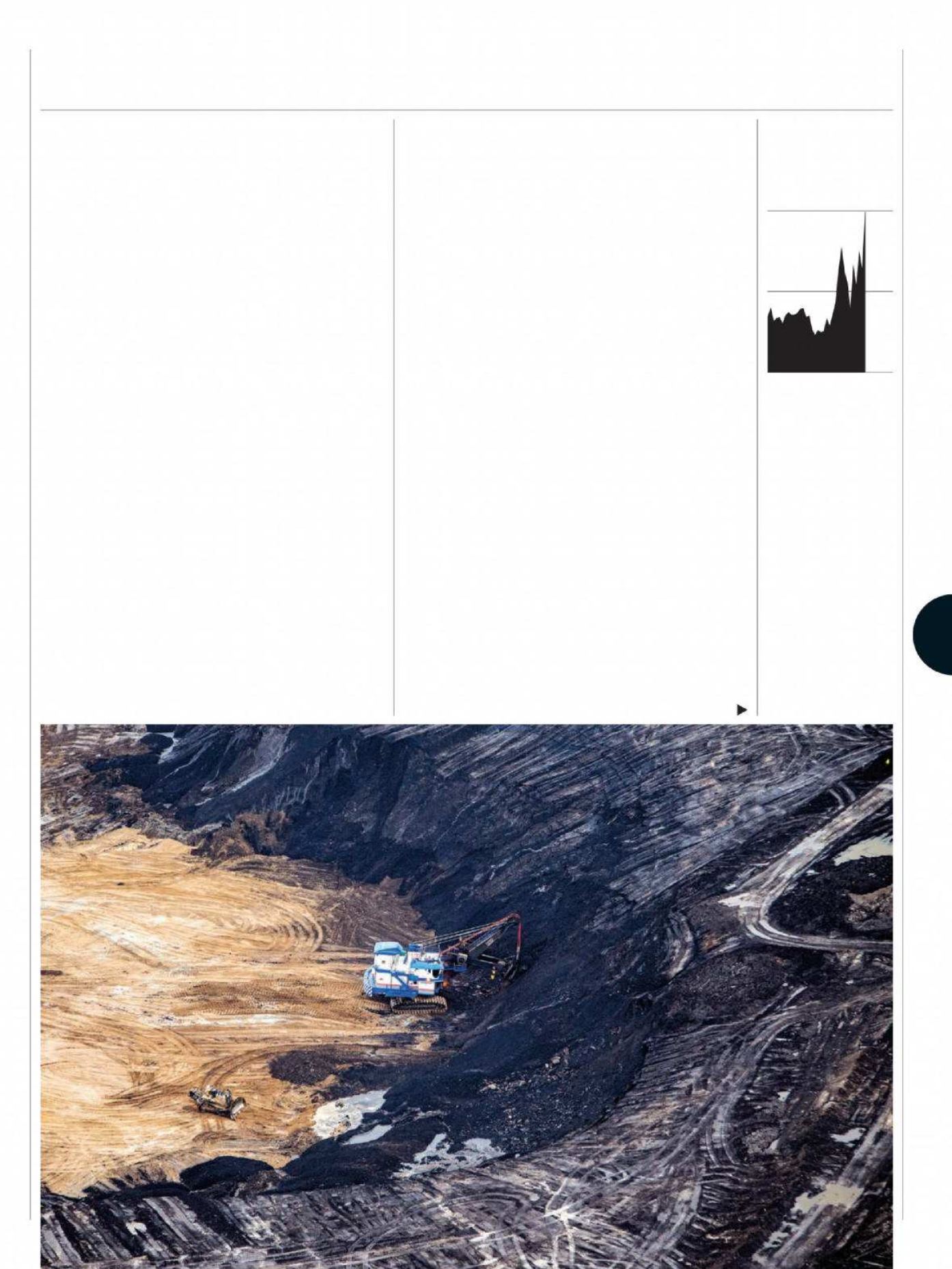

Suncor Energy Inc. CEO Steve Williams, at a

ceremony in early September to celebrate the open-

ing of Suncor’s Fort Hills oil sands mine, a C$17 bil-

lion ($13.3 billion) project in northern Alberta, said

his company probably wouldn’t attempt another

large-scale undertaking in the next decade. “If

you’re coming to that point where you need to

make a decision for the next growth phase, you

need to have conidence that the next pipelines are

coming,” he said in an interview.

In previous oil downturns, the industry had

to contend only with supply and demand luc-

tuations, says Brett Wilson, chairman of Prairie

Merchant Corp., a private merchant bank, and

Canoe Financial LP, an investment management

irm. The current obstacles are deeper and more

permanent. “We seem to be ighting structural

issues now,” he says. “Canada has been delinked

from the global markets, and we are no longer par-

ticipants in the normal cycle of energy.”

Wilson blames the government for giving

environmental concerns too much weight.

Operators of oil

sands mines like Fort

Hills in Alberta are eager

for new outlets for

their crude