ECONOMICS

Bloomberg Businessweek

October 8, 2018

41

Because economies in Europe and Japan are

less buoyant, the process of monetary policy nor-

malization has been a lot slower. After a prolonged

period of aggressive asset purchases and negative

interest rates, the European Central Bank is inally

reducing its monthly bond buying and has signaled

both the likelihood of ending it this year and the ini-

tiation of rate hikes at the end of the summer next

year. At the same time, it would explicitly keep on

the table the option of reversing course should the

econom

y lose steam and inlation fall away from its

target. The Bank of Japan remains more cautious.

The Fed’s rate increases, along with concerns

about the contagion and the spillover of a possible

trade war, have contributed to a signiicant down-

turn in currencies and stocks in emerging markets.

U.S. stocks have continued to outperform those

of other countries, with particularly large recent

and cumulative diferences vs. emerging markets,

including some 20 percentage points so far this year.

This economic and policy divergence will

become increasingly challenging for the global

economic system. Here’s how the timeline is

likely to play out, through the fourth quarter and

beyond. Higher growth and interest rates in the

U.S. would fuel both capital inlows from abroad

and the repatriation of some U.S. funds held

there, thereby bolstering the dollar. That could

also aggravate trade tensions, the intensity of

which would likely depend largely on the degree

to which U.S. trading partners (particularly China)

are willing to make concessions.

This would threaten emerging countries with

renewed currency turmoil, higher borrowing

costs, and lower availability of private credit to

roll over maturing debt. The longer these condi-

tions persist, the higher the probability they would

undermine economic growth, aggravate inlation,

and expose an expanding set of inancial vulner-

abilities. Such spillovers would, in turn, increase

the probability of spillbacks creating headwinds

for the advanced economies.

Further economic and policy divergences in

the next few months would also be planting the

seeds for their own demise over the longer term.

How this gap will close matters a great deal for

both the global economy and inancial markets.

Convergence from below—a pickup in European

and Japanese growth—would lower inancial tensions

by reducing pressures on foreign exchange markets

and interest rates, easing trade tensions, and open-

ing a wider window for the gradual and orderly nor-

malization of monetary policy. This would beneit

both advanced and emerging countries, reducing

the risk of destabilizing feedback loops.

Convergence from above, with U.S. growth rates

falling closer to those of others, would be bad news.

Lower income growth in the U.S. would likely

weaken a critical global growth engine, intensify

trade tensions, and further polarize the political

landscape. Also, the likelihood of lower global

income in this scenario would ofset the relief that

emerging economies would feel from lessened

dollar and interest-rate pressures. It would also

expose them to unsettling periods of strained mar-

ket liquidity in the midst of waves of forced selling.

How should investors navigate this in both the

short and longer term? With such large dispersion

in asset prices between the U.S. and the rest of the

world, it would be understandable for investors

to position their portfolios in the fourth quarter

for the “antidivergence” trade. Yet, as tempting as

this may be, it could also be premature.

Over the next few weeks, we should expect the

continuation—indeed, intensiication—of the eco-

nomic and policy divergences that favor U.S. assets

in relative terms. It gets a lot more interesting over

the longer term: The longer divergence persists, the

higher the probability of a regime break in markets.

Should investors anticipate a pickup in the imple-

mentation of sound pro-growth measures in Europe

and Japan, they would be well-advised to evolve into

greater global diversiication, and do so in the con-

text of an overall increase in risk-taking. But if the

expectation is for policy implementation to continue

to underwhelm—the more likely outcome based on

current indications—then continued favoring of U.S.

assets would need to be accompanied by a reduction

in overall risk exposures. —

Mohamed A. El-Erian

*FORECAST; DATA: INTERNATIONAL MONETARY FUND, FEDERAL RESERVE, EUROPEAN CENTRAL BANK, BANK OF JAPAN

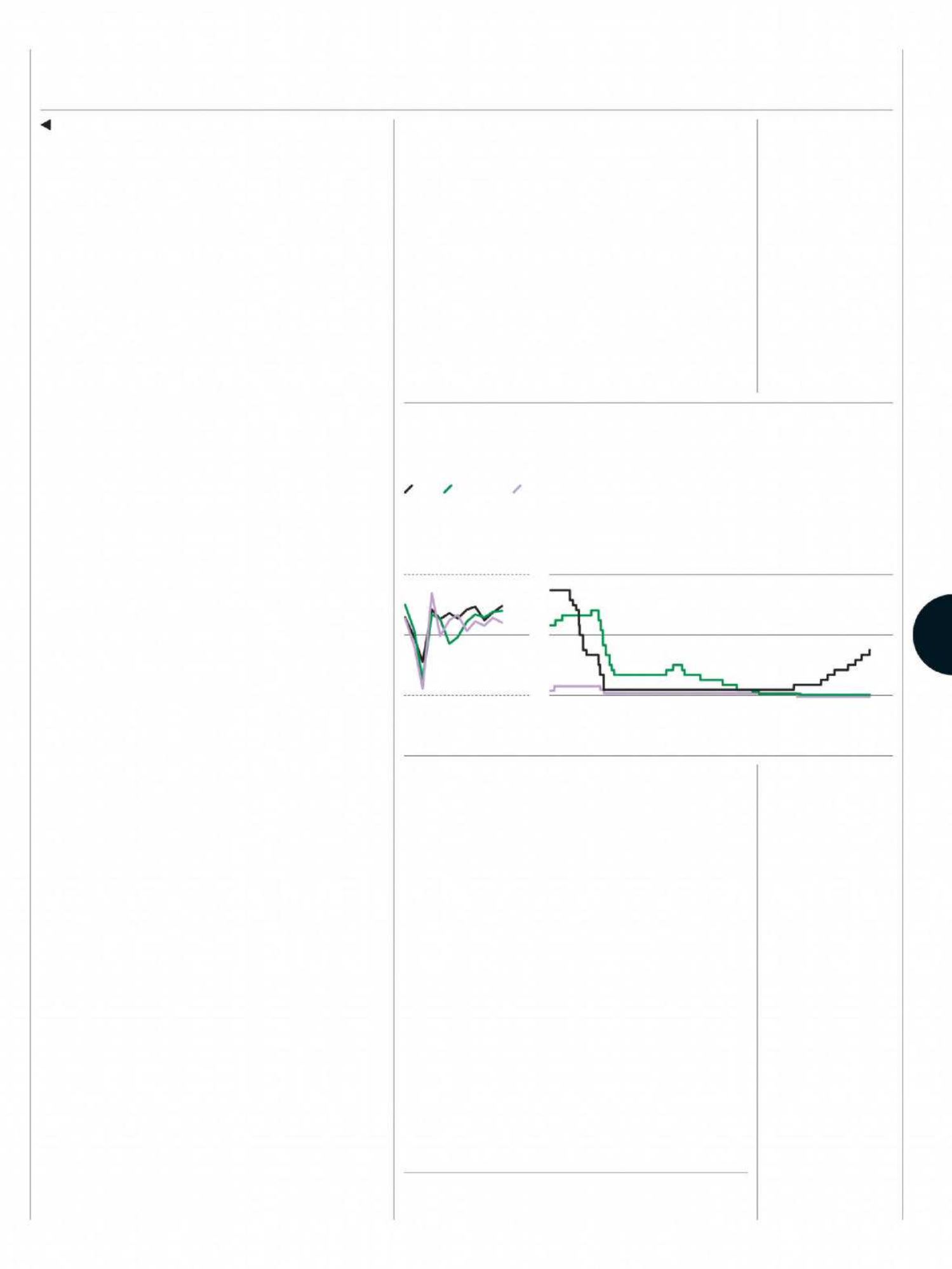

Growing Apart

The world’s developed economies are moving further out of sync

U.S.

Euro area Japan

2007

2018*

1/1/07

9/28/18

Annual GDP growth,

year-over-year

Central bank’s benchmark interest rate

6%

0

6%

3

0

-6

THE BOTTOM LINE The divergence between the U.S. and other

economies can’t last. If Europe and Japan can’t stimulate enough

growth, the global economy will be much more vulnerable.