The Economist

September 22nd 2018

The world this week

7

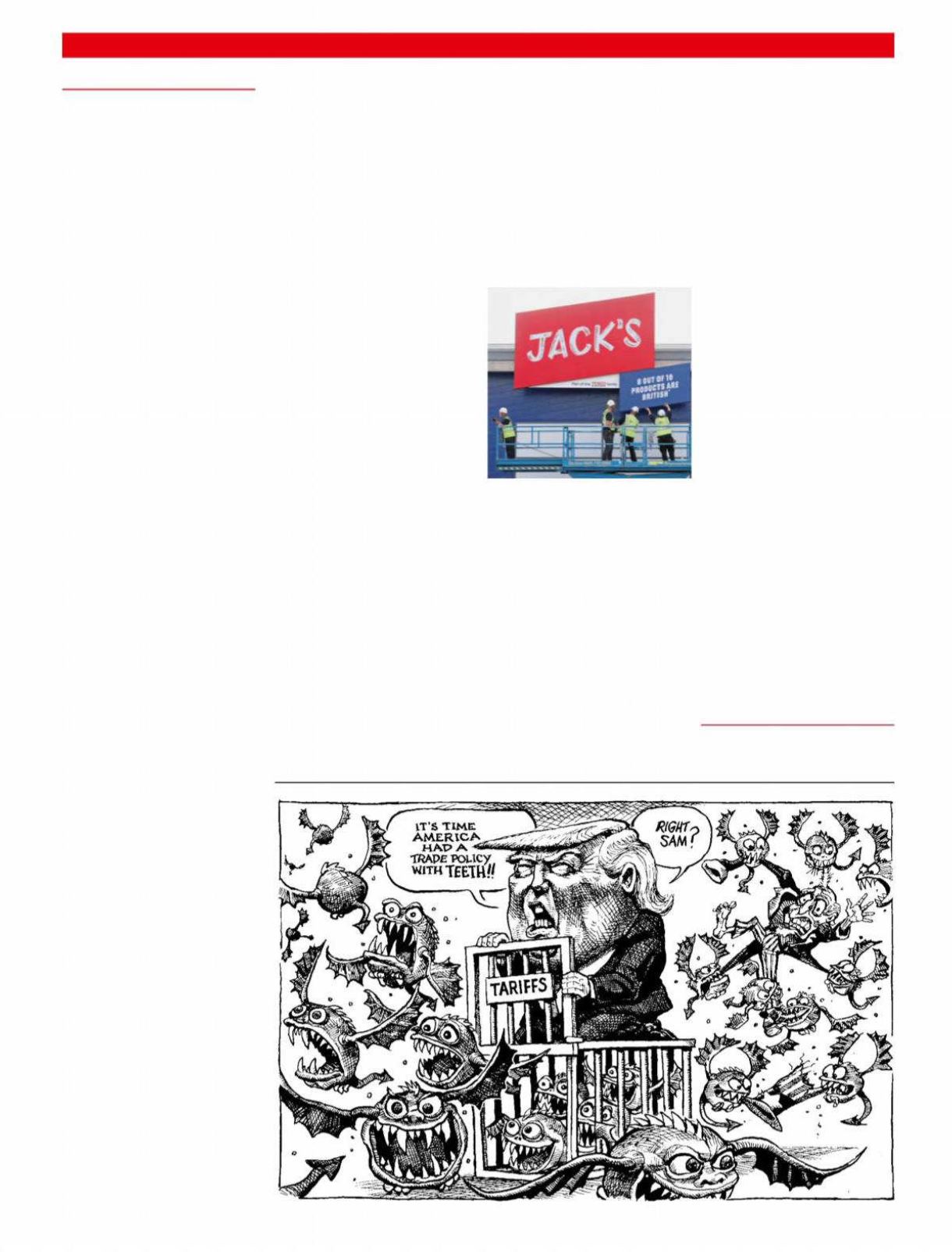

The

tradewar

between China

and America ratcheted up

again. The Trump administra-

tion announced that tariffs

would be imposed on a fur-

ther $189bn-worth ofChinese

imports, including furniture

and car parts. A rate of10%will

apply fromSeptember 24th,

rising to 25% from January1st if

there is no peace deal by then.

China retaliated, slapping

duties on another $60bn-

worth ofAmerican goods.

Russia

experienced its first

interest-rate rise in four years,

an increase of 0.25 percentage

points to 7.5%. The country’s

central bankblamed inflation

of 3.1% in August.

Britain also sawhigher

in-

flation

than expected, 2.7%, in

August.

House prices

in Lon-

donmoved in the opposite

direction, falling by 0.7% in the

year to July, the largest drop

since September 2009.

The

EuropeanCentral Bank

confirmed plans towind

down its programme of quan-

titative easing by halving

monthly bond purchases, to

€15bn ($17.5bn), fromOctober.

It pointed to the robustness of

European labourmarkets as

explanation for themove.

Dredging up the Baltic

In thewake of amoney-laun-

dering scandal that sawan

estimated €200bn in question-

able, much of it Russian, funds

flow through its Estonian

branch between 2007 and

2015, Thomas Borgen, the chief

executive of

Danske Bank

,

resigned. The bankwas

warned by Russian regulators

about the branch as early as

2007. Despite furtherwarnings

froman internal whistle-

blower in 2013 and Estonian

regulators in 2014, the bank

only began its own internal

investigation in 2017, commis-

sioning a report froman ex-

ternal lawfirm that concluded

that executives “did not breach

their legal obligations”.

On its trading debut inHong

Kong, the shares of

Meituan

Dianping

jumped by over 7%.

The loss-making firm, which

has 340musers, is known as

China’s “everything app”. It is

also theworld’s largest food-

delivery firm.

A leadingmanufacturer of

brakes used in lorries and

trains,

Knorr-Bremse

, an-

nounced plans to list in Frank-

furt. Valued at €10bn, it may be

Germany’s biggest

IPO

of 2018.

Tesla

confirmed that Ameri-

ca’s Department of Justice had

requested documents relating

to the announcement in Au-

gust by its boss, ElonMusk,

that he had secured funding to

take the company private.

The European Commission

announced it was investigat-

ing

BMW

,

Daimler

and

VW

over possible collusion to

avoid competing to develop

emissions-limiting devices,

such as ones that can clean

nitrous oxides fromdiesel cars,

or particles frompetrol ones.

Separately, the commission

also announced that it would

investigatewhether

Amazon

used data from sales by third-

party sellers on its platform to

gain an edge in decidingwhat

products it should sell itself,

and at what price. No formal

case has yet been begun.

Marc Benioff, a founder of

Salesforce, a software com-

pany, and hiswife, Lynne,

bought

Time

magazine from

Meredith, a publisher, for

$190m. Mr Beniofffollows in

the footsteps of JeffBezos,

Amazon’s founder and fellow-

billionaire, who bought the

Washington Post

in 2013.

Jack’s beanstalks

Tesco

announced it was

launching a newdiscount

chain, Jack’s, to compete

head-onwith two German

discount retailers, Aldi and

Lidl. In recent years, the pair

have gained an ever-growing

share of the fiercely compet-

itive British grocerymarket.

Einar Aas, a Norwegian trader,

made enormous losses in

derivatives tied to

Nordic

electricitymarkets

, after his

bet that prices in Scandinavia

would stay high relative to

German oneswas scuppered

by forecasts of rain. Beyond

consigning him to bankruptcy,

the soured bets also burned

through over €100m, or two-

thirds, of themutual default

fund at Nasdaq’s commodities

exchange, where the futures

contractswere traded. Swedish

regulators promised to in-

vestigate howone trader al-

most wiped out the pot.

The Public Investment Fund,

Saudi Arabia

’smain sover-

eign-wealth fund, tookon

$11bn of debt froma consor-

tiumof banks in its first-ever

borrowing. The fund is tasked

not just with safekeeping the

kingdom’swealth but also

with diversifying away from

oil and into new industries.

Getting high on valuations

Canadian cannabis compa-

nies

are blooming in the

lead-up to the legalisation of

recreational use of the drug in

October.

Tilray

, a British Co-

lumbia-based andNasdaq-

listed firm, surged by 38% on

September19th alone, giving

the firm, with $20m in revenue

in 2017, a valuation of over

$16bn. Its value thereby sur-

passed that of

Canopy

, a

fellowCanadian rival worth a

mere $11.2bn. Dreamy stuff.

Business

For other economic data and

news see Indicators section