10 Leaders

The Economist

September 22nd 2018

1

I

N HIS trade war with China,

President Donald Trump ap-

pears to have the upper hand.

The new tariffs his administra-

tion unveiled this week, which

will raise the share of Chinese

imports subject to levies to at

least 44%, are unlikely to dam-

penAmerica’s sizzling economy, or to boost inflation bymuch.

Though some firms will be disrupted, most Americans will

not notice the damage (see Finance section). China, however,

is under pressure. Its growth seems to be slowing and its stock-

market is down almost a quarter from its peak in January. Chi-

na’s government has announced retaliatory tariffs against

American goods, but it is fast running out of imports to tax.

During conflict, an imbalance in strength should lead to a

swift resolution. Here the side with the advantage may pro-

long the war. That is because America has several goals, some

of themunachievable.

Unjustwar

The official justification for the tariffs is rooted in anger about

Chinese mercantilism—anger which is shared across the rich

world. China gives vast and opaque subsidies to its state-

owned firms. It requires exporters to hand over intellectual

propertyas a conditionofaccess to itsmarket. Theworld’s con-

sumers benefit from the artificially cheap imports that result.

But trade of this sort is unsustainable, politically and economi-

cally. America is right to demand that China play fair.

That is not the limit of Mr Trump’s ambition, however. He

also wants to eliminate America’s trade deficit with China,

which he mistakenly sees as a transfer of wealth. He has

broadcast hisdesire to forcemanufacturing supplychains back

to America. And his administration has identified China as a

strategic competitor. Some of the president’s advisers seem to

relish the chance to do it economic harm.

TheWhiteHousemayargue that China’s abuse of the rules,

the trade deficit and the decline of American industry are one

and the same. They are not. Even without subsidies, China,

like most other emerging markets, would enjoy a substantial

cost advantage over America. The trade deficit, meanwhile, is

tied to the difference between domestic saving and invest-

ment. Tariffs might cut the bilateral deficit with China, but

America would find it nearly impossible to shrink its overall

deficit without engineering a domestic recession.

The goal of rolling back decades of American deindustrial-

isation is a pipe-dream. Should America succeed in forcing

supply chains back onshore, it will find that many fewer jobs

are attached, because of rapid automation and productivity

growth. American manufacturing’s share of

GDP

has fallen

only by a fifth since 2000, while its share of employment is

down by a third. Besides, the lowest-skilled jobs would not go

to America, but to low-wage Asian countries, like Vietnam.

There is a faint hope that Mr Trump’s advisers and allies

will play good cop to his bad cop, using tariffs as a bargaining

chip in rewriting global trading rules to constrain China’s mer-

cantilism—a legitimate goal. More probably, the bad cop—who

is, after all, in charge—will refuse to be stood down, because of

his obsession with trade deficits and jobs and because Chi-

nese leaders seemunwillingor unable to contemplate reforms

that would strengthenmoderate voices in TeamTrump.

The prospects for any truce with China look grim. Recent

history suggests that tradedisputes arehard to settle. Tariffs im-

posed on Chinese tyres in 2009 under President Barack

Obama, a free-trader, lasted three years. Mr Trump’s recent

trade agreementwithMexico does not include an end to levies

on its steel and aluminium. America’s latest escalation against

China is nomore likely to be speedily reversed.

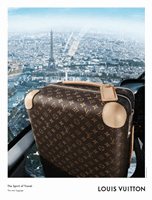

7

Trade

Hunker down

US tariffs on China

Value of imports, 2017, $bn

Effective from:

0 50 100 150 200

Jul 6th 2018

Aug 23rd

Sep 24th

America’s tariffs onChina have several goals—some of themunachievable

T

HE two superpowers of arti-

ficial intelligence (

AI

) are

America and China. Their tech

giants have collected the most

data, attracted the best talent

andboast the biggest computing

clouds—the main ingredients

needed to develop

AI

services

from facial recognition to self-driving cars. Their dominance

deeply worries the European Union, the world’s second-larg-

est economic power (see Business section). It is busily concoct-

ing plans to close the gap.

That Europe wants to foster its own

AI

industry is under-

standable. Artificial intelligence is much more than another

Silicon Valley buzzword—more, even, than seminal products

like the smartphone. It is better seen as a resource, a bit like

electricity, that will touch every part of the economy and soci-

ety. Plenty of people fret that, without its own cutting-edge re-

search and

AI

champions, big digital platforms based abroad

will siphon off profits and jobs and leave the

EU

a lot poorer.

The technology also looms large in military planning. China’s

big bet on

AI

is partly a bet on autonomousweapons; America

is likely to follow the same path. Given the doubt over wheth-

er Americawill always bewilling to come to Europe’s defence,

some see spending on

AI

as amatter of national security.

Both arguments make sense. But can Europe support

AI

Artificial intelligence

AI, EU, go

Europe can influence the development ofAI for the better—and not just at home