20

QILAI SHEN/BLOOMBERG

the retired GM vice chairman. In some video

ads, viewers don’t even see a Cadillac until halfway

through the spot, he says. “ ‘Dare Greatly’ has been

a disaster from beginning to end,” Lutz adds. “When

you have product that is in many ways better than

the competition, you tell people about it. You don’t

dare them to take a leap of faith on your cars.”

Carlisle agrees the division needs to freshen

its advertising. He and Deborah Wahl, Cadillac’s

new marketing boss, are working on ads that will

emphasize features and new technologies. That’s

one reason Cadillac will soon move its headquar-

ters back to Michigan after several years in New

York: The marketers will be close to engineering.

A GM lifer, Carlisle most recently ran the compa-

ny’s Canadian business. He was named Cadillac divi-

sion president in April, replacing Audi veteran Johan

de Nysschen, who saw U.S. sales continue to falter

during his four-year tenure before leaving amid dif-

ferences over the direction of the brand.

The new X

T4, geared to appeal to younger buy-

ers, recently went on sale at around

$35,000 but

will cost almost $50,000 with options. (The least-

expensive Caddy had been the ATS sedan, start-

ing at $39,000.) Small Cadillacs have rarely gained

traction in the marketplace. In the 1980s there was

the widely panned Cimarron, a rebadged Chevrolet

Cavalier that’s now synonymous with the brand’s

decline. Another low: the midsize Catera from

the late 1990s, which was little more than an Opel

Omega family car. Even the ATS, a much better car

which boasts good quality and a sporty ride, logs

fewer than 1,000 sales a month in the U.S.

Other automakers, from Audi to BMW and

Mercedes-Benz, have managed to sell proitable

quantities of small SUVs. Mercedes-Benz has bejew-

eled its cabins, and Volvo has become a winner

with artful, Scandinavian interior design, tweaks

that make even a small SUV feel luxurious. With the

XT4, Cadillac is paring down some of the touches

premium buyers expect, says Eric Noble, president

of consulting irm The CarLab. While the XT4 uses

real wood in its interior, the wood trim is narrower

than on many premium cars and its center con-

trol console isn’t as blinged out as competitors’,

Noble says. “The irst question that comes to mind

is, where’s the luxury?”

Phillip Kucera, the car’s interior design man-

ager, points to hand stitching on the dashboard

leather and wood grain made from diferent tim-

bers to give it a modern look. But he acknowledges

that with a starting price of $35,000, Cadillac can

spend only so much decorating the XT4.

Alexander Edwards, president of marketing

consultant Strategic Vision Inc., says the XT4’s

technology and lower price have a good shot at

attracting younger buyers to Cadillac. But all that

may not matter, Lutz says. Restoring Cadillac’s luxe

reputation could take years, during which car-

makers may be competing with ride-sharing com-

panies ofering autonomous transportation. If the

interlopers succeed, he says, consumers would be

more attracted to brands like Uber and Lyft than

to a particular car manufacturer.

“I don’t think there are enough decades left in

the branded automobile business as we know it to

achieve a comeback,” Lutz says.

—David Welch

THE BOTTOM LINE Starting at $35,000, Cadillac’s new XT4 small

SUV is intended to woo younger buyers. It’s part of the vintage

brand’s eighth reboot in two decades.

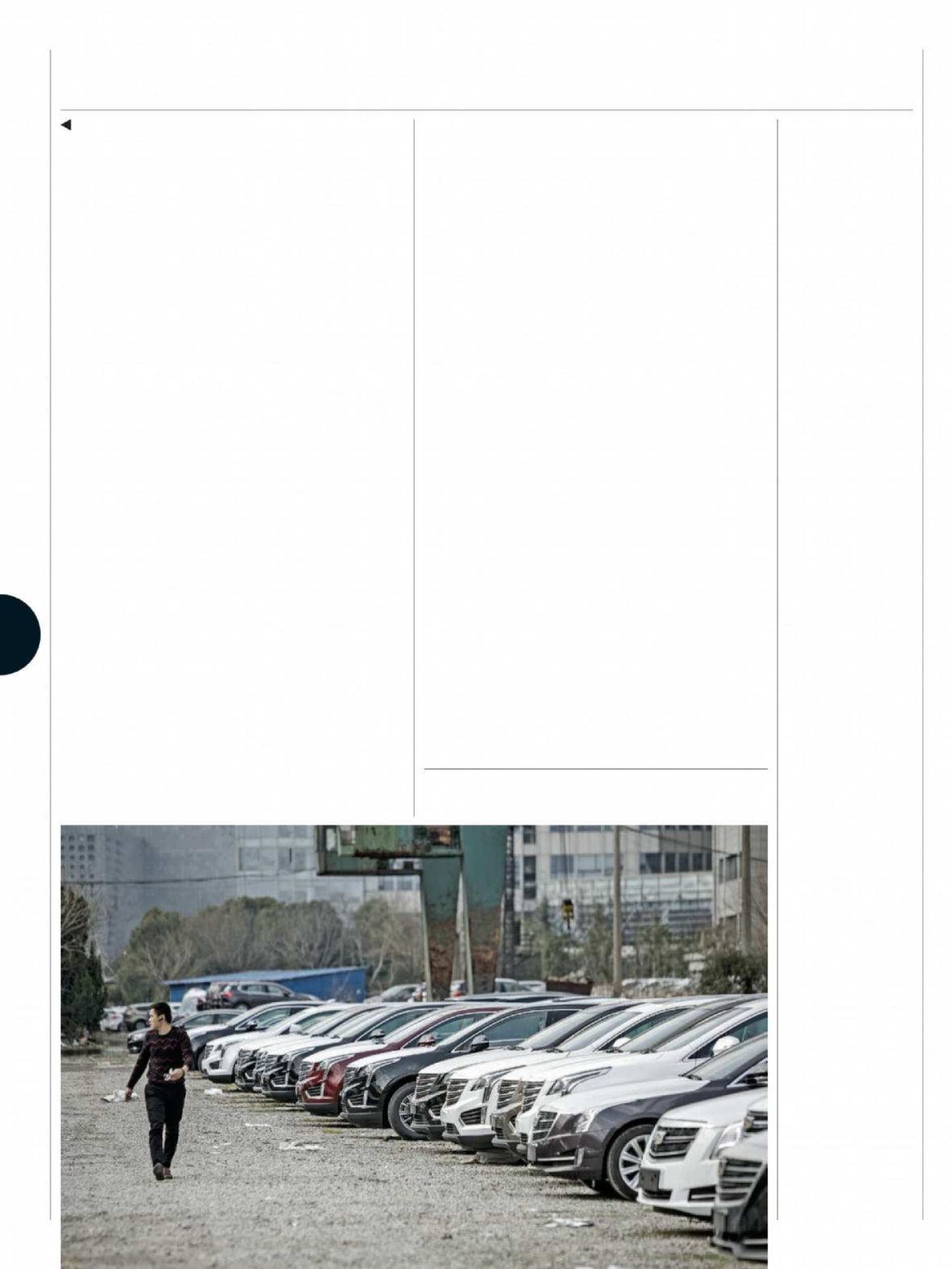

⊳ A Shanghai dealer lot

stocked with Cadillacs

BUSINESS

Bloomberg Businessweek

October 8, 2018