The Economist

June 9th 2018

Economic and financial indicators

77

Other markets

% change on

Dec 29th 2017

Index

one

in local in $

Jun 6th

week

currency terms

United States (S&P 500)

2,772.4 +1.8 +3.7 +3.7

United States (NAScomp)

7,689.2 +3.0 +11.4 +11.4

China (Shenzhen Comp)

1,779.2 +2.5 -6.3 -4.7

Japan (Topix)

1,777.6 +2.4 -2.2 +0.3

Europe (FTSEurofirst 300)

1,512.1 +0.2 -1.1 -3.9

World, dev'd (MSCI)

2,119.4 +0.9 +0.8 +0.8

Emerging markets (MSCI)

1,144.4 +2.8 -1.2 -1.2

World, all (MSCI)

515.7 +1.1 +0.5 +0.5

World bonds (Citigroup)

939.9 nil

-1.1 -1.1

EMBI+ (JPMorgan)

793.2 -0.5 -5.1 -5.1

Hedge funds (HFRX)

1,267.3

§

+0.1 -0.6 -0.6

Volatility, US (VIX)

12.3 +14.9 +11.0 (levels)

CDSs, Eur (iTRAXX)

†

67.3 -1.9 +49.1 +44.9

CDSs, N Am (CDX)

†

64.3 -1.3 +31.0 +31.0

Carbon trading (EU ETS) €

15.9 +0.4 +95.9 +90.4

Sources: IHS Markit; Thomson Reuters. *Total return index.

†

Credit-default-swap spreads, basis points.

§

Jun 4th.

The Economist

commodity-price index

2005=100

% change on

one

one

May 29th Jun 5th*

month year

Dollar Index

All Items

156.5

156.3

-0.5 +11.1

Food

159.4

156.7

-2.4 +2.4

Industrials

All

153.5

155.9

+1.7 +22.0

Nfa

†

148.0

148.9

+2.6 +13.9

Metals

155.8

158.9

+1.3 +25.6

Sterling Index

All items

214.5

213.1

+0.8 +7.4

Euro Index

All items

168.3

166.6

+1.1 +7.3

Gold

$ per oz

1,302.0 1,295.3

-1.0

nil

West Texas Intermediate

$ per barrel

66.7

65.5

-5.1 +36.0

Sources: Bloomberg; CME Group; Cotlook; Darmenn & Curl; FT; ICCO;

ICO; ISO; Live Rice Index; LME; NZ Wool Services; Thompson Lloyd &

Ewart; Thomson Reuters; Urner Barry; WSJ. *Provisional

†

Non-food agriculturals.

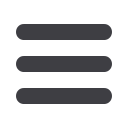

Markets

% change on

Dec 29th 2017

Index

one

in local in $

Jun 6th

week

currency terms

United States (DJIA)

25,146.4

+1.9

+1.7

+1.7

China (Shanghai Comp)

3,115.2

+2.4

-5.8

-4.2

Japan (Nikkei 225)

22,625.7

+2.8

-0.6

+2.0

Britain (FTSE 100)

7,712.4

+0.3

+0.3

-1.1

Canada (S&P TSX)

16,183.9

+0.8

-0.2

-3.8

Euro area (FTSE Euro 100)

1,208.4

+0.7

-0.1

-2.9

Euro area (EURO STOXX 50)

3,460.8

+0.6

-1.2

-4.0

Austria (ATX)

3,300.4

-1.8

-3.5

-6.2

Belgium (Bel 20)

3,791.1

+0.2

-4.7

-7.4

France (CAC 40)

5,457.6

+0.6

+2.7

-0.2

Germany (DAX)*

12,830.1

+0.4

-0.7

-3.5

Greece (Athex Comp)

781.1

+4.2

-2.7

-5.4

Italy (FTSE/MIB)

21,807.6

nil

-0.2

-3.0

Netherlands (AEX)

562.2

+0.8

+3.2

+0.3

Spain (IBEX 35)

9,791.6

+2.4

-2.5

-5.3

Czech Republic (PX)

1,073.3

-0.6

-0.5

-3.6

Denmark (OMXCB)

900.4

+0.7

-2.9

-5.6

Hungary (BUX)

37,157.5

+6.7

-5.6

-10.7

Norway (OSEAX)

1,004.4

+1.4

+10.7 +11.2

Poland (WIG)

59,080.9

+3.1

-7.3

-12.1

Russia (RTS, $ terms)

1,177.7

+1.3

+2.0

+2.0

Sweden (OMXS30)

1,559.1 -0.2 -1.1 -7.8

Switzerland (SMI)

8,545.0 -0.4 -8.9 -10.2

Turkey (BIST)

96,657.7

-6.9

-16.2

-31.1

Australia (All Ord.)

6,137.4

+0.7

-0.5

-2.8

Hong Kong (Hang Seng)

31,259.1

+4.0

+4.5

+4.1

India (BSE)

35,178.9

+0.8

+3.3

-1.9

Indonesia (JSX)

6,069.7

+1.0

-4.5

-6.6

Malaysia (KLSE)

1,777.1

+3.4

-1.1

+0.8

Pakistan (KSE)

44,144.2

+3.8

+9.1

+4.1

Singapore (STI)

3,467.8 +0.7 +1.9 +1.9

South Korea (KOSPI)

2,453.8 +1.9 -0.6 -0.6

Taiwan (TWI)

11,201.8 +3.5 +5.3 +5.1

Thailand (SET)

1,738.7

+0.8

-0.9

+1.1

Argentina (MERV)

30,432.4

+7.2

+1.2

-23.7

Brazil (BVSP)

76,117.2

-0.8

-0.4

-12.6

Chile (IGPA)

27,797.3

nil

-0.7

-3.7

Colombia (IGBC)

12,297.3

nil

+7.1 +11.4

Mexico (IPC)

45,181.8

+1.0

-8.5

-12.0

Peru (S&P/BVL)*

21,348.6

+2.7

+6.9

+5.8

Egypt (EGX 30)

15,908.9

-5.1

+5.9

+5.2

Israel (TA-125)

1,382.0

+1.3

+1.3

-1.5

Saudi Arabia (Tadawul)

8,383.2

+4.7

+16.0 +16.0

South Africa (JSE AS)

58,081.9

+4.5

-2.4

-5.4

Ind

i

cato

r

s

for more countries and additional

series, go to:

Economist.com/indicatorsThe Economist

poll of forecasters, June averages

(previous month’s, if changed)

Real GDP, % change

Consume

r

p

ri

ces

Cu

rr

ent account

Low/high range

average

% change

% of GDP

2018

2019

2018

2019

2018

2019

2018

2019

Australia

2.5/3.2 2.2/3.2

2.8 (2.7)

2.8 (2.7)

2.2 (2.1) 2.3

-2.5 (-2.2) -2.4 (-1.7)

Brazil

1.2/2.9 2.2/3.6

2.2 (2.6)

2.8 (2.9)

3.4

4.1

-1.1 (-1.2) -1.5 (-1.6)

Britain

1.1/1.7 0.8/1.9

1.4

1.4 (1.5)

2.5

2.1

-3.8 (-3.7) -3.5 (-3.4)

Canada

1.9/3.2 1.6/3.2

2.3

2.0 (2.1)

2.1 (2.2) 2.0

-2.6 (-2.7) -2.4

China

6.4/6.8 6.1/6.9

6.6

6.4

2.3

2.4

1.1

1.0

France

1.8/2.2 1.6/2.4

2.0

1.9

1.8 (1.7) 1.4

-1.0 (-0.8) -1.1 (-0.9)

Germany

2.0/2.5 1.6/2.7

2.2 (2.3)

2.1

1.7 (1.6) 1.7

7.9 (7.7)

7.5

India

6.6/7.7

7.2/8.2

7.3 (7.2)

7.5

4.7 (4.8) 4.8 (4.7)

-2.2 (-2.0) -2.3 (-2.1)

Italy

1.1/1.6 0.9/1.8

1.4

1.3

1.2 (1.1) 1.2

2.7

2.4 (2.6)

Japan

0.9/1.7 0.7/1.9

1.3 (1.4)

1.2 (1.1)

1.1 (1.0) 1.3 (1.2)

3.9 (4.0) 3.8 (4.0)

Russia

1.3/2.1 1.2/1.9

1.8 (1.7)

1.7 (1.8)

3.0 (3.1) 4.0 (3.9)

3.3 (3.4) 3.0 (2.6)

Spain

2.4/3.1 1.8/3.3

2.7 (2.8)

2.4 (2.2)

1.5 (1.4) 1.5

1.8 (1.7)

1.9 (1.7)

United States

2.6/3.1 2.0/3.5

2.8

2.5

2.5 (2.4) 2.2 (2.1)

-2.6 (-2.8) -2.9 (-3.1)

Euro area

2.1/2.6 1.7/2.8

2.3

2.0

1.6 (1.5) 1.5

3.2 (3.3)

3.1

Sources: Bank of America, Barclays, BNP Paribas, Citigroup, Commerzbank, Credit Suisse, Decision Economics, Deutsche Bank,

EIU, Goldman Sachs, HSBC Securities, ING, Itaú BBA, JPMorgan, Morgan Stanley, RBS, Royal Bank of Canada, Schroders,

Scotiabank, Société Générale, Standard Chartered, UBS. For more countries, go to:

Economist.com/markets