The Economist

May 5th 2018

The world this week

9

T

-Mobile

and

Sprint

decided

to have another go at merging,

announcing a deal that values

the combined company at

$146bn, including debt. The

pair toyedwith the idea of

hooking up in 2014. Antitrust

regulatorswere not keen, as a

mergerwould reduce the

number of bigwireless carriers

in America from four to three.

That issuewill come to the fore

again now.

T

-Mobile and

Sprint argue that their new

companywould have the

capacity to roll out a nation-

wide

5G

networkquickly.

Competition concernswere

also raised in Britain after

Sainsbury’s

said that it had

reached an agreement to buy

Asda

, which is owned by

Walmart. Themelding of

Britain’s second- and third-

biggest supermarket chains

would create a colossus in the

industry, though both brands

would be retained—Asda

pitches its appeal tomore

cost-conscious shoppers than

Sainsbury’s.

Steady on

At its latest meeting, the Feder-

al Reserve left its benchmark

interest rate

unchanged at a

range of between1.5% and

1.75%. The central bank is ex-

pected to raise rates at its next

meeting, in June. The Fed’s

decision came after data indi-

cated that the

American econ-

omy

grewat an annualised

rate of 2.3% in the first quarter,

the slowest pace in a year.

In an abrupt move,

Argenti-

na’s

central bank raised its

benchmark interest rate from

27.25% to 30.25% in an effort to

shore up the peso, which has

taken a battering in currency

markets amidworries about

stubbornly high inflation.

The Trump administration

postponed implementing

tariffs

on steel and aluminium

imports fromcountries in the

EuropeanUnion by amonth,

saying it wantedmore time for

negotiations. The Europeans,

annoyed that they should be

bracketedwith countries like

China, want permanent ex-

emptions from the tariffs,

which Argentina, Australia

and Brazil have attained.

In a $36bn deal that creates

America’s biggest oil-refining

company,

Marathon Petro-

leum

said it would buy

Andeavor

. Andeavor operates

ten refineries in thewestern

United States. Marathon owns

six, but handlesmore oil.

Higher oil prices helped lift

BP

’s

headline profit in the first

quarter by 71%, to $2.6bn. The

energy giant hinted that it

would increase its dividend for

the first time in four years if oil

prices remain buoyant; its

stockhit an eight-year high.

A working strategy

Apple

reported a net profit of

$13.8bn for the first three

months of the year. Although

the rate of growth in iPhone

sales has slowed over the

years, revenue from its signa-

ture product rose by14% com-

paredwith the same quarter

last year, thanks in part to the

more expensive iPhone X.

With1.3bn Apple devices in

use around theworld, its

income fromassociated ser-

vices, such asmusic, soared by

a third. Swimming in cash,

Apple launched another share

buy-backplan, worth $100bn.

Xiaomi

, a Chinese smart-

phone-maker, filed for an

IPO

inHong Kong. The company is

reportedly hoping to raise up

to $10bn, whichwouldmake it

one of the biggest tech

flotations to date.

TeslaMotors’

latest earnings

report raisedmore questions

for investors about the rate at

which it is burning through its

cash reserves. Plagued by

production problems for its

Model 3mass-market car, Tesla

ended the first quarterwith

$2.7bn in cash on hand, com-

paredwith $3.4bn inDecem-

ber. It also reported another

headline loss, of $710m.

Cambridge Analytica

folded.

The data-mining firmhit the

headlines for obtaining infor-

mation on Facebookusers that

was then deployed to help

Donald Trump’s presidential

campaign. The firmblamed a

media “siege” for its decision

to shut up shop.

Ahead of a visit to Beijing by

senior economic officials in the

Trump administration,

China

relaxed the restrictions on

foreign investors becoming

controlling shareholders in

joint-venture securities com-

panies, raising the cap on

foreign ownership from49% to

51%. Only financial institutions

with a “good international

reputation” need apply.

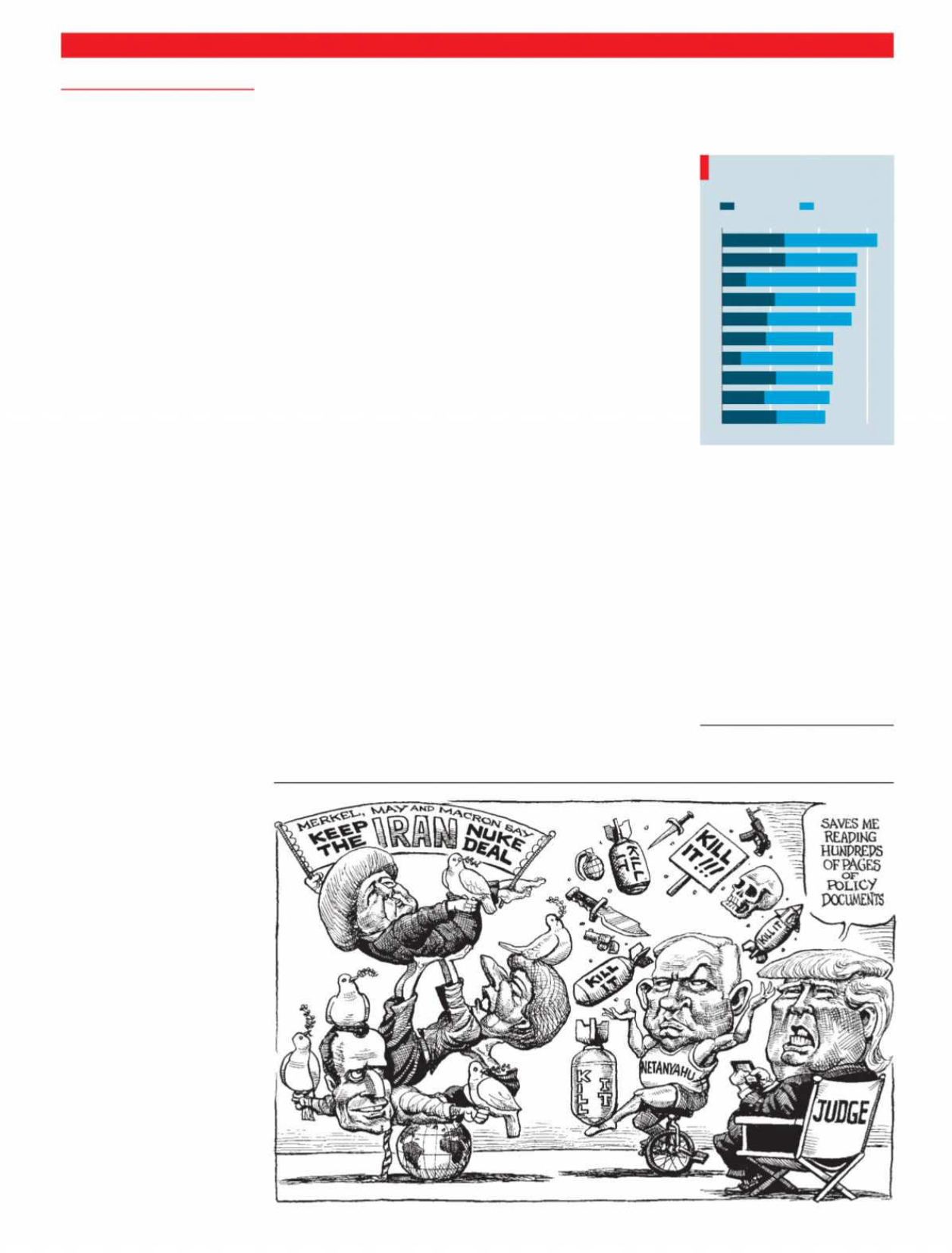

The mouse that roared

Marvel Entertainment, a sub-

sidiary ofDisney, broke box-

office recordswith the release

of

“InfinityWar”

, the latest of

its Avengersmovies, beating

the global record for an open-

ingweekendwith a total of

$641m. “The Force Awakens”,

Disney’s first StarWars outing

after acquiring the Lucasfilm

franchise, still boasts the best

openingweekend in America

after adjusting for inflation. It is

possible that this Avengers

adventuremay be the biggest

yet and take $2bnworldwide.

Business

B

ox off

i

ce open

i

ng weekend

Sources: Box Office Mojo; BLS

Gross receipts, $m, 2018 prices

0

200

400

600

Infinity War

The Force Awakens

The Fate of the Furious

Jurassic World

The Deathly Hallows (Part 2)

Spider-Man 3

The Half-Blood Prince

The Last Jedi

Batman v Superman

The Avengers

United States

Rest of world

For other economic data and

news see Indicators section

РЕЛИЗ ПОДГОТОВИЛА ГРУППА "What's News"

VK.COM/WSNWS