6

The world this week

The Economist

April 14th 2018

MarkZuckerberg attended

hearings in Congress to defend

, after the revelation

that information on 87musers

had been obtained by a politi-

cal-analytics firm linked to the

Trump campaign. Mr Zucker-

berg said he could accept

regulation of the social net-

work, provided it was under

the “right framework”, which

he suggestedmight be some-

thing akin to impending data-

protection rules in Europe. Mr

Zuckerberg’s assured perfor-

mance helped lift Facebook’s

share price by 5.7% over his two

days on the Hill.

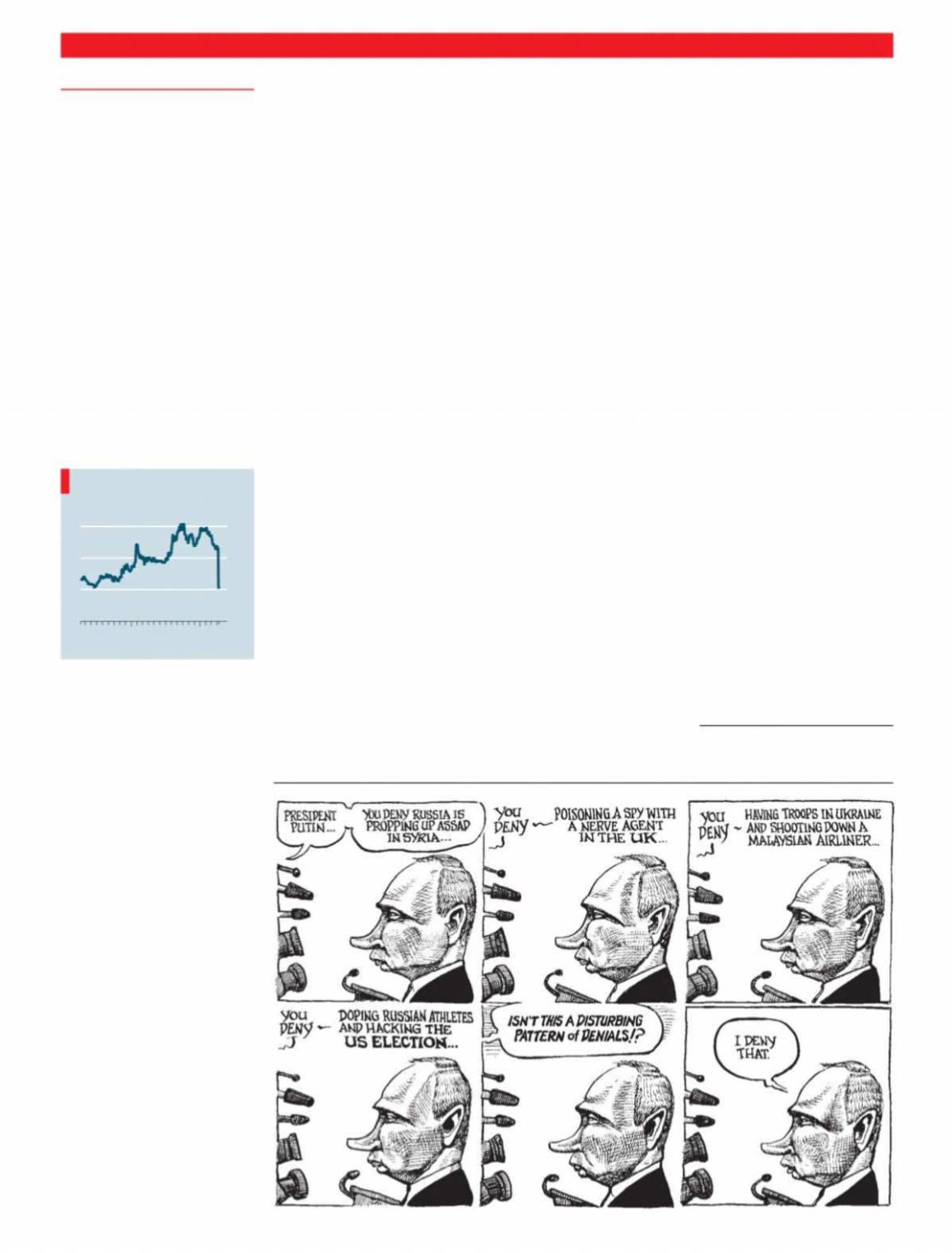

Get ready Russia!

America’s latest round of

sanctions against

Russia

hit

hard, causing Russian stock-

markets to dive and the rouble

to plunge. Chief among the

sanctions’ targetswere seven

oligarchs and12 companies

they own or control, but in-

vestor disquiet wasmore

widely felt, spreading to Sber-

bank, Russia’s biggest bank,

among others. The list includ-

edOlegDeripaska and his

companies, such as Rusal, a

producer of aluminium. Un-

derlining the sanctions’ poten-

cy, IvanGlasenberg, the chief

executive ofGlencore, re-

signed fromRusal’s board,

which he had joined in 2007.

Stockmarkets in general had

another volatileweek, in part

because sentiment fluctuated

about the prospects of a trade

war between America and

China. Heightened geopoliti-

cal tensions over Syria pushed

oil prices

higher (some good

news at least for the Russian

economy). Brent crude

climbed above $72 a barrel, its

highest level since 2014.

Deutsche Bank

ousted John

Cryan as chief executive, three

years into his five-year con-

tract. The German lender has

suffered three consecutive

annual losses and Paul

Achleitner, the chairman, was

said to be unhappywith the

slowpace of the bank’s turn-

around. Still, several investors

complained about themanner

ofMr Cryan’s defenestration,

which couldmake for a turbu-

lent annual shareholders’

meeting next month. The new

CEO

is Christian Sewing, who

headedDeutsche’s retail bank.

A new driver

Deutsche Bankwasn’t the only

illustrious German company

shaking up itsmanagement.

Volkswagen

was reportedly

ready to replaceMatthias

Müller as chief executivewith

Herbert Diess, who heads its

core passenger-car brand. Mr

Müller got the

CEO

’s job in

September 2015, whenMartin

Winterkorn resigned in the

wake of the carmaker’s emis-

sions-cheating scandal.

The Turkish lira fell to another

lowagainst the dollar in part

because of concerns about

Turkey’s

push for growth at

any cost. Recep Tayyip Erdo-

gan, the president, unveiled an

investment package thisweek

and again called for interest

rates to remain subdued. That

spooked investors already

worried that Mr Erdogan’s

pronouncements onmonetary

policy are hampering the

central bank’s freedom to raise

rates. Inflation remains stub-

bornly high at10% and the

current-account deficit has

risen on an annual basis.

Investorswere taken by sur-

prisewhen

Saudi Arabia

sold

$11bn-worth of bondswithout

the customary roadshow. It is

thought that the kingdommay

have been trying to get a jump

on

Qatar

, which it has been

feudingwith since last June

andwhich is in the process of

drumming up support for its

own sale of government debt.

Novartis

added to its expand-

ing gene-therapy business by

agreeing to pay $8.7bn for

AveXis

, which specialises in

treatments for spinal muscular

atrophy, a genetic condition

that causes progressivemuscle

wasting.

The prancing unicorn

JackMawas reportedly prepar-

ing to raise up to $10bn in a

round of private funding for

Ant Financial

, amobile-

payments group that he

controls. MrMa created Ant in

2011 to house the Alipay

network, which he spun out

fromhis Alibaba empire. With

520musers, Alipay is the

world’s biggest mobile-pay-

ments platform, thoughmost

of its business is in China. Mr

Ma’s latest round of fund-

raising could value Ant at

$150bn, whichwouldmake it

themost valuable startup in

theworld, way ahead of the

likes ofUber andDidi Chux-

ing, two ride-hailing firms.

The European BankingAu-

thority reported that 77% of the

top earners among

European

bankers

(thosewith remuner-

ation packages of at least €1m,

or $1.1m, in 2016) were based in

Britain. That was a longway

ahead ofGermany, the next

country in the ranking, where

5% of top earners resided.

A

fat-finger

mistake by an

employee at a South Korean

brokerage led to 2.8bn shares

worth $100bn being issued to

staff in error. The employee

typed “shares” instead of

“won” when distributing

dividends in the Korean

currency. It took the brokerage

half an hour to spot the slip,

duringwhich time 16members

of staff tookadvantage of their

windfall and sold their

wrongly allocated stock.

Business

Un

i

ted Company Rusal

Source: Thomson Reuters

Share price, HK$

2016

17

18

0

2

4

6

For other economic data and

news see Indicators section