49

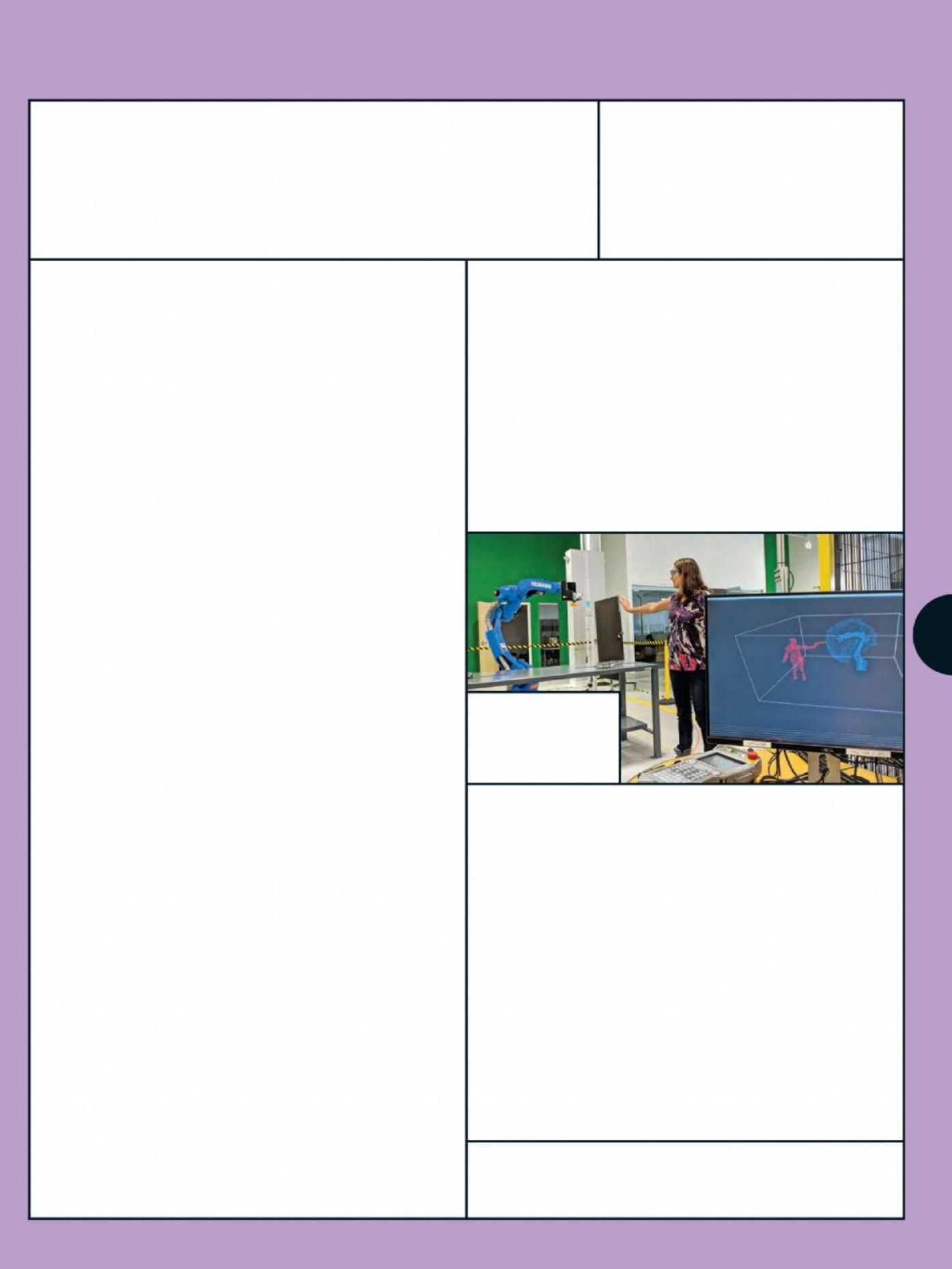

COURTESY VEO ROBOTICS

SOLUTIONS

Bloomberg Businessweek

October 8, 2018

LidarWillBringMore

Robots toFactories

manufacturers, including Fanuc Corp. and Yaskawa Electric

Corp., to run experiments for aircraft manufacturers, oil and

gas drillers, and appliance makers. Veo’s potential annual

revenue, Sobalvarro says, could top $1 billion in five years.

That’s a bold claim for a company that so far has only

$13 million in funding from Google Ventures, Lux Capital

Management, and Next47, a venture firm started by

Siemens AG. Veo might raise more this fall just as it starts

shipping to customers.

In a video demonstration, Sobalvarro places lidar sen-

sors around a 6-foot-tall Kuka robot that lifts a 15-pound

suspension component onto a table so workers can attach

other parts. Such human-machine interaction cuts the time

to install rubber bushings, used to reduce noise and vibra-

tion, to 24 seconds from 43.

The safety constraints required for today’s factory

robots can make even routine maintenance tricky. The

copper tips on robots that weld metal car bodies wear

out constantly because of high temperature and volt-

age. Changing one takes less than two minutes but often

requires more time because a supervisor has to autho-

rize the padlocking of surrounding robots before anyone

can climb inside the metal safety cage.

Veo’s technology provides electronic assurance that

the robots will stop when necessary. “Our dream is to

walk into a factory and have any machine you approach

go into a ‘safe mode’ until you leave,” Sobalvarro says. “It’s

the end of fear.” —

John Lippert

THE BOTTOM LINE Veo, which has raised about $13 million from Google

Ventures and Siemens’s VC firm among others, says annual sales could top

$1 billion in five years.

Veo Robotics is using the laser

technology to end safety fears

in car manufacturing

Most automakers use robots to weld and paint the metal

bodies of their cars. But the final assembly line, consisting

of about 500 ever-changing tasks such as the installation

of engines, dashboards, and seats, has defied most e

forts

to replace workers with robots. There’s a good reason:

Increasing automation requires robots to cooperate with

humans on the factory floor, and that can be dangerous.

“Being with a robot in a tight space is like standing next

to a horse,” says Patrick Sobalvarro, co-founder of Veo

Robotics Inc. of Waltham, Mass. “If the horse is calm and

likes you, and knows where you are, you’re perfectly safe.

But you have to know it’s not going to surprise you or step

on you or crush you against the wall.”

Veo has pioneered the use of three-dimensional flash

lidar—which bounces lasers of objects to help determine

what’s nearby—to create real-time maps of robots, humans,

and everything else inside a factory. Its proprietary soft-

ware slows a robot down and stops it when a human gets

too close. The system also shuts all nearby robots when it

can’t positively identify what’s happening in a workstation.

Lidar, and its blend of sensing and computer analysis

in real time, is making self-driving cars a reality. As costs

drop, the technology is spreading. A Velodyne Lidar Inc.

sensor that sold for $75,000 a decade ago can be had

today for $99. Alphabet Inc.’s Waymo and General Motors

Co.’s Cruise unit, front-runners in the autonomous vehi-

cle race, rely on lidar sensors. Almost $1 billion has been

invested in automotive lidar companies over the past four

years, according to a report by Bloomberg NEF.

“Veo is the first to use lidar on the assembly line,” says

Joe Gemma, chief executive o

icer in the U.S. for Kuka

Robotics Corp. Kuka, whose customers include Tesla Inc.

and GM, is helping the startup test its system. “We think

of final assembly as the holy grail of automation,” he says.

“We’ve really been lacking in our ability to use automation in

this area because of the additional cost of protecting peo-

ple working in close proximity. These new lidar technolo-

gies could change this.”

Guided by Veo sensors, robots could install windshields

and seats, Gemma says. Humans would still be around,

using their dexterity and judgment to solve problems. That’s

not what happened in the 1980s, when a GM automation

campaign led to robots that painted each other instead of

cars, or earlier this year, when Tesla had to scrap a robotic

conveyance system used to bring parts to the line.

Veo is also working with other big industrial robot

Veo’s system uses

lidar to track robots

and everything

around them